Shrimps to Humpbacks: Understanding the Crypto Hierarchy

Cryptocurrencies have experienced explosive growth in popularity over the past five years. According to a recent report by Crypto.com, the total user base for cryptocurrency reached over 425 million by the end of 2022, accounting for 6% of the world's population. This number will only increase as crypto becomes more popular in the coming years. However, the number of users is not the only criterion when considering crypto adoption. What is equally important is how the token is distributed. For example, 10,000 people holding 0.1 BTC each is a far better option than one person holding 900 BTC and the remaining 9,999 people holding 0.01 BTC each.

Why token distribution is important

One of the founding tenets of the cryptocurrency ecosystem is the decentralization of power, which refers to power over the network and power over the coin. This is even more important with Proof-of-Stake, where those who control the coin control the network. Luckily, unlike TradFi, where we can never determine how power is concentrated, cryptocurrency's transparent nature allows us to get a good estimate of its exact distribution and determine if a small percentage of users have outsize control over the ecosystem.

Categorization

The widely used hodler categorization is based on Bitcoin, so we will use the same metric here. Later in the article, we will discover how to use the same metric to categorize other coins and tokens. While there are no hard rules on categorization, the most widely used method comes from Glassnode, which has divided the hodlers into eight different categories:

Humpbacks & Whales: These two groups are at the top of the food chain in Crypto. Most of us would have heard of Whales in Crypto, but Humpbacks are even larger. It refers to addresses with more than 5,000 Bitcoin, while Whales refer to addresses with 1,000-5,000 Bitcoin. These groups include large institutions and people who got into Bitcoin very early. Their actions can have a considerable impact on the market.

Sharks & Dolphins: These two categories hold a substantial amount of Bitcoin but not enough to have a major impact on the market. Sharks are addresses with 500-1,000 Bitcoin, and Dolphins have 100-500 Bitcoin. Most institutions that didn’t fall into the first two categories will be part of these two groups. Recent on-chain analyses suggest that Sharks are increasing in number while Whales are decreasing.

Fish & Octopus: While the names may give the impression that these are small investors, they are anything but that. Fish wallets have 50-100 Bitcoins, while Octopus wallets have 10-50. So, the least amount of money with which an individual can become an Octopus is $300,000 based on the current Bitcoin price. While these wallets have large sums of money from an individual point of view, their impact on the market is largely negligible.

Crabs & Shrimps: These are the bottom two categories; Crab holds 1-10 BTC while Shrimps hold less than 1 BTC. Together, these two groups constitute the largest number of Bitcoin wallets. However, they hold only 17% of the total Bitcoin supply. For Bitcoin to achieve its initial aim and become a universal coin, we need to see this group hold the vast majority of the coins in circulation.

Current Supply Distribution

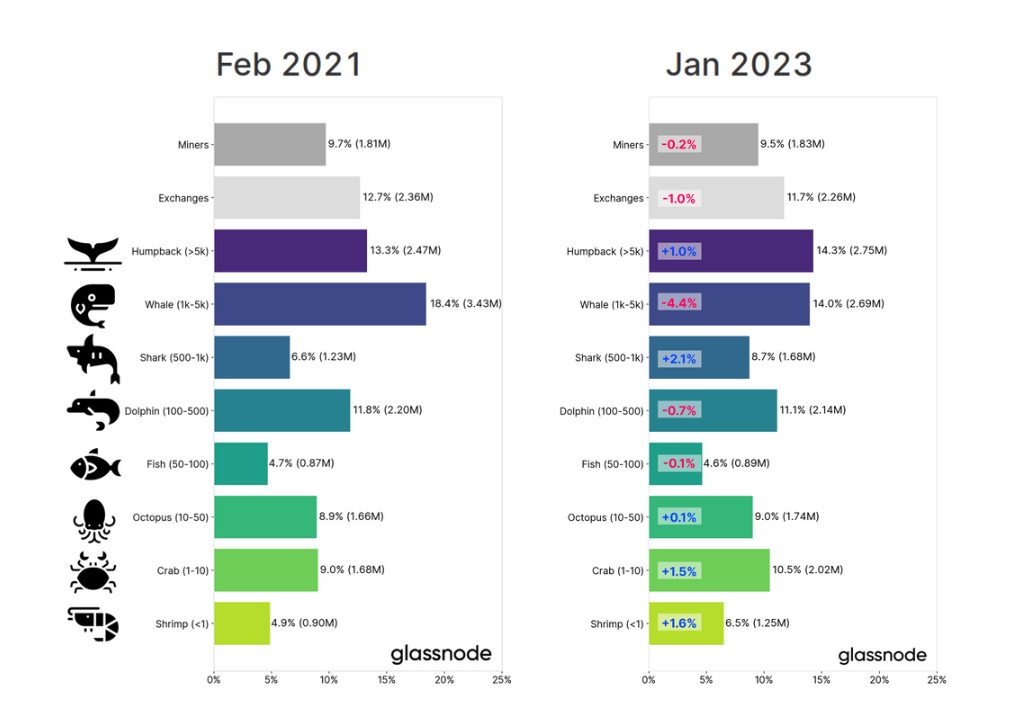

Glassnode recently published a Bitcoin distribution chart that looked at how much each group holds as of January 2023 and compared it with a similar chart from February 2021. The chart shows the top two groups (Humpbacks and Whales) hold more than a quarter of the total Bitcoin supply; between them, they hold 28.3% of all the Bitcoins in circulation. In contrast, the bottom two groups (Crabs and Shrimp) hold only 17%.

While this is not good news, we also need to look at how this ownership changes over time. Compared to 2021, the bottom two groups have seen an increase in their holding by 3.1%, while the top two groups have seen their holding decrease by 3.4%. Ideally, we will continue to see this trend develop in the future. As Bitcoin gets more popular, we will likely see it move from a few Humpbacks and Whales to millions of Crabs and Shrimps.

Ranking Hodlers of Other Coins

While there are different hodler ranking systems depending on the author and the institution that publishes it, almost all use Bitcoin as the base asset. However, we can also use the same metric to sort the Hodler size of other coins.

One way to do this is to take the value in USD for each category and apply the same to other coins. For example, Humpbacks have over 5000 BTC, around $150,000,000 in today’s value. Using the same value, a wallet must have 75,000 ETH to be considered a Humpback.

While this is a reasonable metric, the fact that ETH's market cap is smaller than Bitcoin means that anyone with 75,000 ETH would end up having more power over the Ethereum network than someone with 5000 BTC with over Bitcoin.

Therefore, in this article, we will track the percentage of circulating supply to determine our hodler categories for other coins. For example, a Humpback holds 5000 BTC, around 0.03% of the current supply. If we use the same metric on Ethereum, a Humpback would need to have 31,116 ETH. For simplicity’s sake, we will mark that as 30,000 ETH. Using the same calculation, we can get can sort the hodlers of other coins as follows:

| Ethereum | BNB | Cardano | Solana |

Humpbacks | 30,000 | 40,000 | 9,000,000 | 100,000 |

Whales | 6,000 | 8,000 | 1,800,000 | 20,000 |

Sharks | 3,000 | 4,000 | 900,000 | 10,000 |

Dolphins | 600 | 800 | 180,000 | 2,000 |

Fish | 300 | 400 | 90,000 | 1,000 |

Octopus | 60 | 80 | 18,000 | 200 |

Crabs | 6 | 8 | 1,800 | 20 |

Shrimps | Less than 6 | Less than 8 | Less than 1,800 | Less than 20 |

Since different tokens have different emission rates, we must regularly revise the numbers to keep them current. However, remember that this is just a metric; the real goal is to ensure those in the last two categories hold a much larger percentage of the supply than those in the top two. This would enable crypto to become a truly decentralized force free from whale manipulations.

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.