The Bitcoin Halving and Its Effect on Miner Revenue

A spate of news articles in recent weeks talking about the profitability of Bitcoin miners has brought the focus on the upcoming Bitcoin halving and its effect on miners. The halving is a crucial event for Bitcoin, during which the network reduces the reward paid out to miners by half. It’s an important mechanism that’s responsible for keeping the total Bitcoin in circulation to under 21 million, which in turn keeps the coin deflationary. While the halving has been covered before on SynAcademy, it was done so from the investor’s perspective.

In this article, we will look at how the halving affects miners and what measures can be taken to keep the coin deflationary while also ensuring that the miners who operate the network can continue to remain profitable.

The Idea Behind the Bitcoin Halving

When Satoshi Nakamoto created Bitcoin, the halving was designed to give outsized rewards for miners during the early days. The main purpose was to encourage people to start mining and help establish the network. At the start, Bitcoin had 50 BTC rewards for every single block. While large rewards played an important role in bootstrapping the network, it was equally important to reduce the reward systemically to ensure the total supply remained under 21 million.

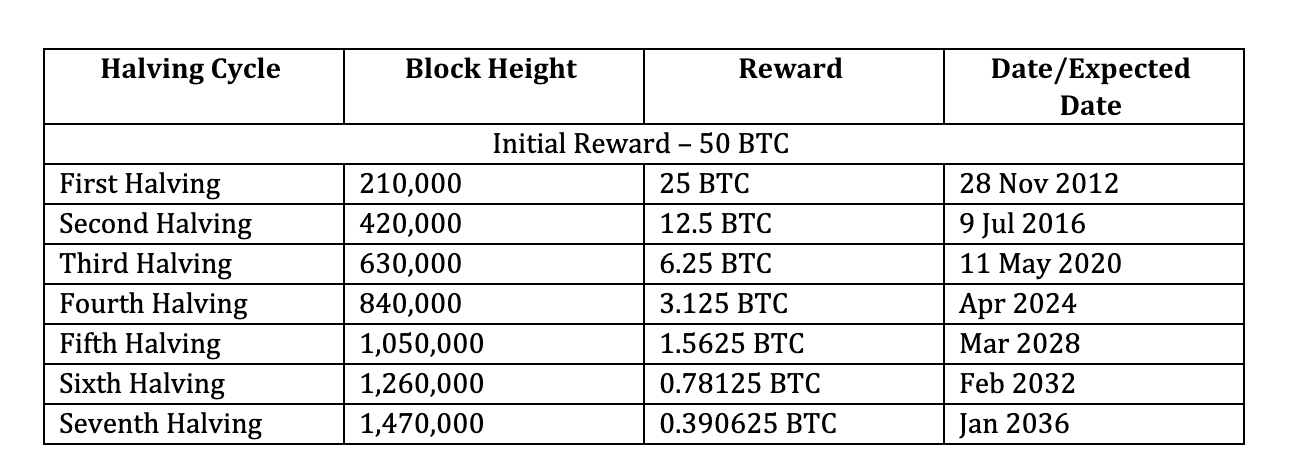

This is when the halving mechanism was introduced. After 210,000 blocks, which takes roughly four years, the block reward given out to miners gets reduced by half. After the first halving, the reward was reduced to 25 BTC, the second halving reduced it further to 12.5 BTC, the third halving to 6.25 BTC, and the fourth will reduce it to 3.125.

The table below gives the miner reward and expected miner reward after each block from 2008 to 2036.

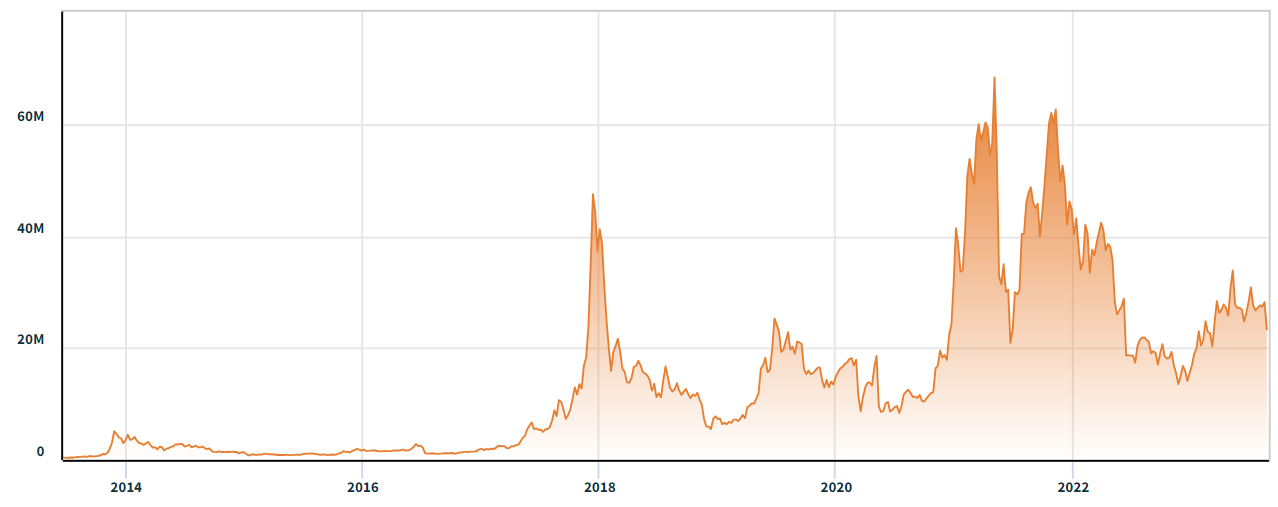

During its creation, Satoshi formulated that as Bitcoin adoption grows, the diminishing block rewards would be mitigated by the higher price of Bitcoin and the increasing reward from transaction fees. However, this hasn’t played out as expected. The chart below shows the miners' revenue from 2014 to this date. As we can see, the revenue peaked in 2021, and it’s currently at the same level that it was in 2019.

The Current State of the Network and Miners

Miners have always been the backbone of the Bitcoin network. They secure the network, validate its transactions, and create and maintain the blockchain. This means the miners’ ability to run their operations for profit is crucial for the survival of Bitcoin itself. Satoshi’s original vision has held up remarkably over time, as miners can still operate the network effectively and make a profit in doing so. This achievement has created the first decentralized currency powered by people from around the globe.

However, continuous halving does pose a threat to this ecosystem. This was partly caused by Bitcoin's shifting from its initial purpose as a currency to its new role as a store of value. This shift meant the number of transactions in the Bitcoin network did not increase as dramatically as initially hoped, and therefore, the value generated from transaction fees did not rise enough to compensate for the reductions from halving.

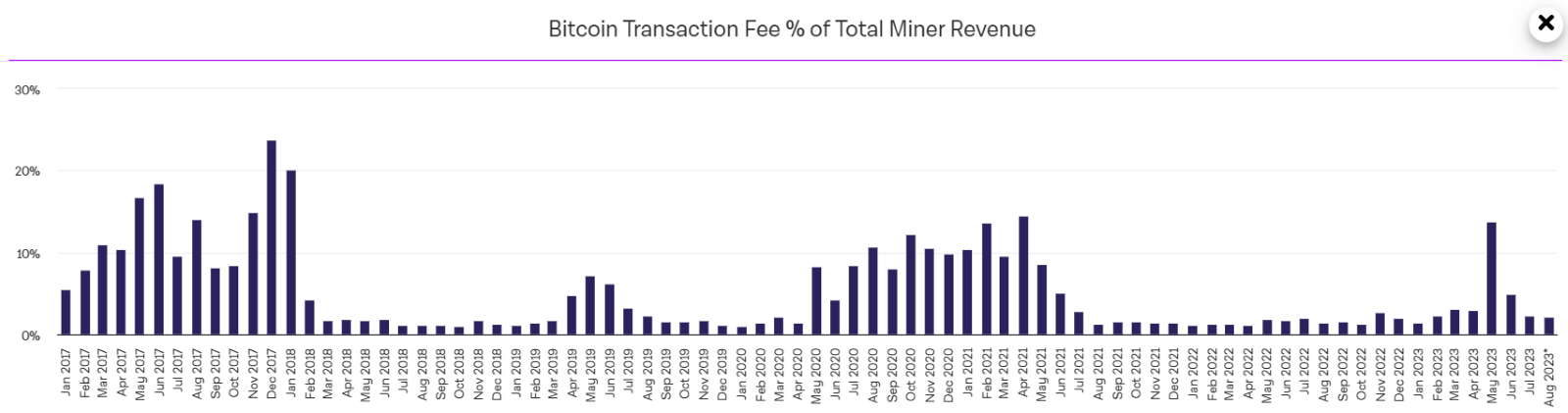

The chart below depicts the percentage of miner revenue that comes from transaction fees. Notably, in 2017, as Bitcoin gained mainstream adoption, the transaction fee percentage increased from less than 10% to above 23%. But since the narrative change, it has never reached such highs. Even during the 2021 bull market, when Bitcoin reached $65,000, the transaction fee percentage peaked at 14.5%. For the last five years, the average has hovered around 4%, with the current figure standing at a meager 2%.

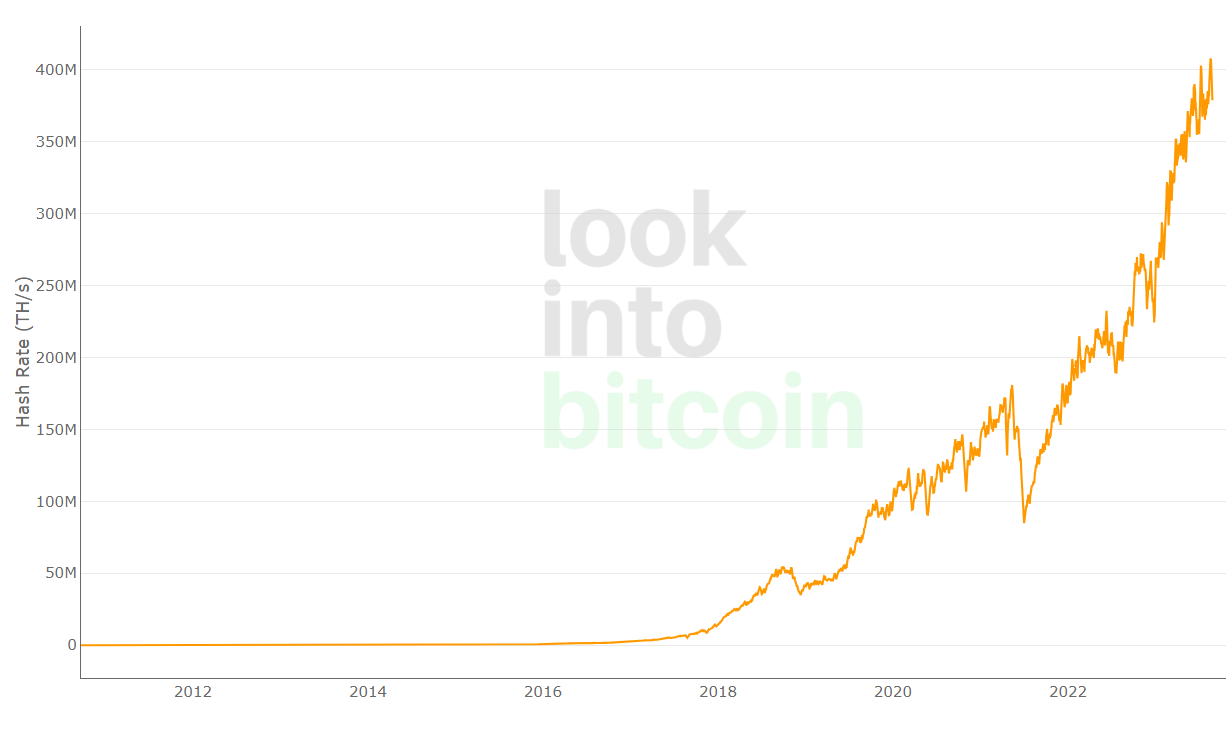

An additional pain point for the miners is the ever-increasing hash rate. Despite the fall in revenue, the number of miners in the network only continues to grow, which results in increasing hash power required to mine every block. The chart below shows the hash rate required for Bitcoin mining; we can see a steady increase from six million in 2017 to four hundred million in 2023. Compared with the first chart, it’s clear that while the hash rate has increased 66x, the revenue during the same period has only increased 4x.

Moving Forward

A healthy mining operation is essential for the survival of Bitcoin. If we see a sharp decline in miner participation, it could lead to a decrease in network security, an increase in transaction confirmation times, and a risk of entire mining operations getting centralized by a few large players. To avoid this, it’s important to focus on increasing miner revenue and making sure they remain profitable in the long term.

As we discussed earlier, one way to secure miner profitability is by increasing the transaction fee portion of the revenue. If we go back to Chart 2, we see the transaction fee percentage has remained at extremely low levels since 2021, except in May 2023, when it reached 13.7%, which is almost as high as the peak of the previous bull market. The Ordinals and the development of the BRC-20 standard brought this about. The increased network activity associated with these new types of assets on Bitcoin pushed the transaction fee higher, allowing miners to make more money even during the bear market phase. Many in the industry have hailed this as the answer to Bitcoin’s long-term sustainability.

Another avenue to miner profitability involves reducing the cost of mining. With the current increase in energy cost brought about by geopolitics, finding a more sustainable energy source for Bitcoin mining has become a new priority. The industry is now experimenting with different mining methods, including using flare gas from oil wells that would otherwise get burned off, using solar power to provide sustainable, clean energy, and using geothermal power for cheap and continuous power supply.

With innovation happening on both the revenue front and the cost front, we can be cautiously optimistic that the industry will find a way to prevent a profitability crisis from affecting the miners and, by extension, the network.

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.