Opening the Oyster: Exploring SynFutures’ Revolutionary AMM

Automated Market Makers (AMMs) are a pivotal innovation that made DeFi possible by providing a unique mechanism for trading and liquidity. Unlike traditional markets, AMMs rely on liquidity pools, a collection of funds of two or more tokens locked in smart contracts. AMMs work on a formula-based approach where the ratio of tokens on the pool is used to determine asset prices. This differs from the order book model, where the asset price is the last traded price. This innovation enabled anyone to provide liquidity and participate in the market as a liquidity provider.

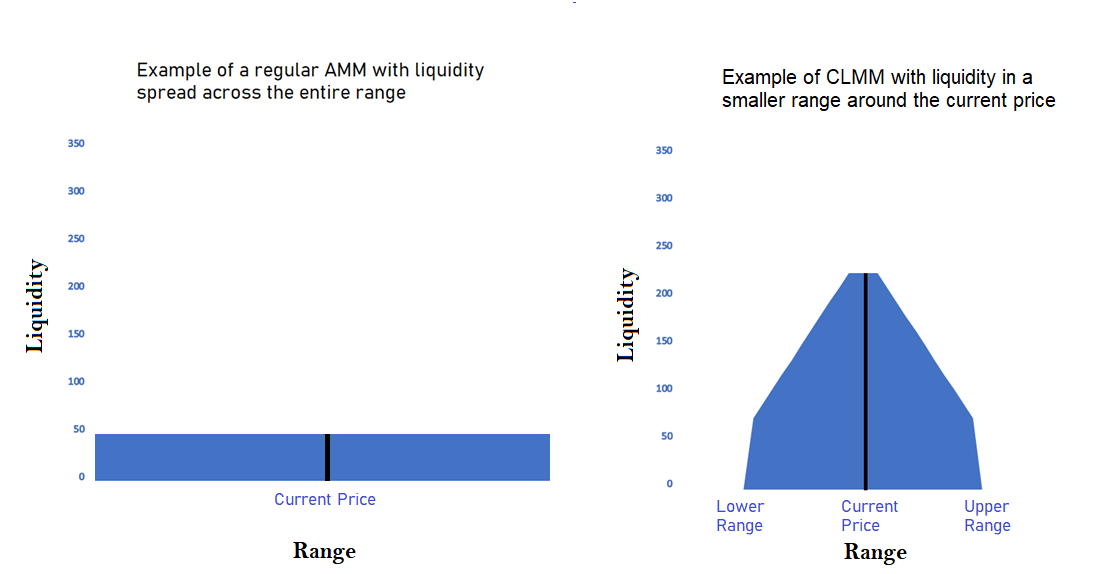

While they democratized market access and allowed the listing of several long-tailed assets, AMMs also come with one major challenge: they are not capital-efficient. Compared to a traditional order book model where the liquidity is concentrated around the current price, it’s spread across the entire price range in the AMM model. This increases slippage for the trader and makes liquidity less efficient for the LP, affecting both parties negatively.

What is Oyster AMM?

With this in mind, SynFutures created Oyster AMM, a revolutionary model designed to be highly capital efficient so that liquidity providers get more out of their capital and traders have an efficient trading mechanism.

Oyster AMM improves upon the Synthetic AMM (sAMM) model used in SynFutures V1 and V2. With the knowledge gained from those two previous versions, we are introducing several new features with Oyster AMM that could significantly enhance liquidity and improve the trading experience for crypto derivatives traders. Let’s take a deeper look at some of those features below.

Concentrated Liquidity and Its Benefits

Concentrated liquidity refers to allocating liquidity within specific price bands, enhancing the capital efficiency of the system. As mentioned earlier, in the order book model, the capital is generally concentrated around the last traded price, while in the AMM model, it’s spread across the entire price range. Concentrated liquidity Market Makers (CLMMs) are designed to mimic the order book model by concentrating capital close to the asset's current price. This allows the liquidity provider to choose a range within which their liquidity would be active. The example below shows how the same amount of liquidity will be allocated in regular AMM and CLMM models.

As we can see, for the same amount of capital, the CLMM model provides much more liquidity above and below the current trading price than the regular AMM model. This can lead to a significant boost in capital efficiency for the liquidity provider. On Uniswap V3, the concentrated liquidity model provides a capital efficiency boost of 20,000x. Since Oyster AMM uses only one token to give concentrated liquidity to both sides, it can provide nearly 39,997x capital efficiency.

Synthetic AMM and Single-Token Concentrated Liquidity

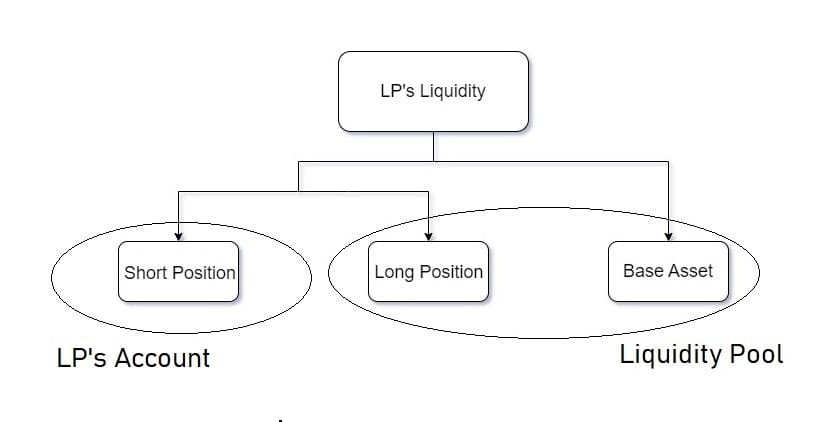

Oyster AMM in SynFutures V3 is inspired by the synthetic Automated Market Maker (sAMM) model from our previous versions and the Concentrated Liquidity Market Maker (CLMM) model from Uniswap V3. The sAMM model allowed LPs to list and add liquidity to any trading pair with a single asset called the Quote asset. The Base asset is then automatically synthesized by the contract. The diagram below depicts how a two-asset liquidity pool is synthesized using a single asset.

Part of the LP’s liquidity is used as the base asset, while another part is used to create the quote asset's long and short positions. The long position of the quote asset and the base asset is placed in the liquidity pool, while the short position is placed in the user account. This creates a Synthetic AMM, which traders can then use.

While this approach will not work for a spot DEX, it can be a game changer for a derivatives DEX, where the users are not trading the underlying asset but only a derivative of that underlying asset. Oyster AMM refines this concept by introducing a concentrated liquidity approach that directs resources towards specific price bands, optimizing capital efficiency.

Fully On-Chain Order Book

In addition to single-token concentrated liquidity, Oyster AMM supports the traditional order book system where market makers can place buy and sell limit orders at a single price point. Unlike some spot AMM models that use highly concentrated liquidity as a proxy for limit orders, Oyster AMM enables native limit orders similar to those in traditional centralized exchanges.

The integration of limit orders also provides an infinite boost to capital efficiency as a market order can be filled with zero slippage as long as enough limit orders are on the other side at the same price. This level of efficiency is unattainable in constant product AMM models, where even the smallest trade incurs at least some slippage.

Unified Liquidity System

Since Oyster AMM supports the CLMM and traditional order book method, it can provide a unified liquidity system that integrates both these models into a seamless user experience. While other models have attempted to do the same, they have done so by combining on-chain AMM with off-chain limit order systems or by segregating the two where trade requests are split between the two systems. Such models bring with them the risk of non-atomic executions or increased inefficiencies. But Oyster avoids such risks by combining both models into one unified liquidity.

In Oyster AMM, although the liquidity from the concentrated range is distributed along a specific pricing curve and the liquidity from limit orders is just within a single point, the two types of liquidity do not conflict. Instead, they complement each other.

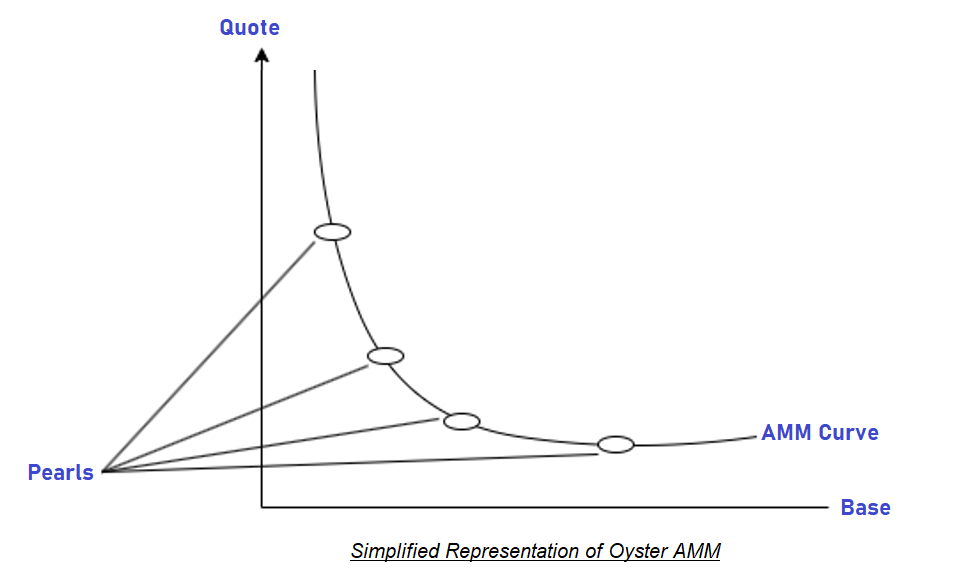

To achieve this, Oyster AMM uses a structure called ‘Pearl,' a collection of concentrated liquidity covering a price point, and all open limit orders are on the same price point. See the figure below for a simplified representation of how liquidity is structured in Oyster AMM.

Below is a step-by-step explanation of how orders are executed in Oyster AMM. For more information, read the SynFutures V3 whitepaper draft.

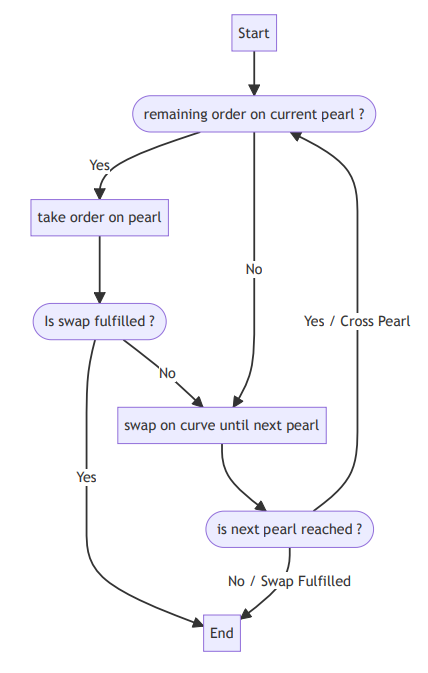

- When a market taker places a new order, Oyster first checks the Pearl at that price point.

- It then takes all the limit orders present at that price point. The transaction is completed if the liquidity in the limit orders is enough to fill the market taker’s order.

- If not, Oyster AMM then takes liquidity from the AMM curve. This increases the price and moves it along the curve.

- If the order gets fulfilled on the curve, then the transaction ends. If not, the price keeps increasing until the next pearl with a limit order is reached.

- Here, the same process is followed again, where the liquidity from the limit order is filled first, and then liquidity from the AMM is taken.

- This process continues until the entire order is filled.

Oyster AMM helps reduce the slippage for traders by taking limit orders before the AMM curve. The flow chart below describes the exact swap procedure followed in Oyster AMM.

Dynamic Fees and Stabilized Mark Price for User Protection

One of the primary functions of any DeFi project is to protect users from market manipulations by bad actors. Oyster AMM incorporates advanced financial risk management mechanisms from past protocol iterations and new ones to enhance user protection and price stability. One such mechanism is a dynamic penalty fee system that discourages price manipulation by imposing penalties for significant deviations between trade and mark prices. k price. The penalty ratio is defined by a cubic function of the deviation, which means the penalty fee will be proportional to the deviation caused by the trade.

When calculating the mark price, SynFutures uses a stabilized mark price mechanism with an exponential moving average process to smooth out the mark price over time. This mitigates the risk of sudden price fluctuations, which could end up causing mass liquidations for users.

Enhanced Capital Efficiency

From the ground up, Oyster AMM is designed to be highly capital-efficient. As discussed earlier, it combines buy and sell limit orders on single price points with concentrated liquidity, providing better pricing for traders and increased capital efficiency for liquidity providers. Combining concentrated liquidity with single token liquidity and the order book model has allowed SynFutures to set a new standard for capital efficiency with Oyster AMM. The table below shows the capital efficiency in the same range between UniSwap v3 and Oyster AMM. As we can see, Oyster AMM is almost twice as efficient as UniSwap v3 under this price range.

Model | Price Range | Capital Efficiency Boost |

Oyster AMM | 99.99% to 100.01% | 39,997.0x |

UniSwap v3 | 99.99% to 100.01% | 20,000.5x |

Not only is Oyster AMM more capital efficient, but it can also enable zero-slippage trades under certain scenarios. Because it combines the AMM model with the Orderbook model, as long as there is enough liquidity in the orderbook to fulfill a trade, it’s possible that the trade would get executed with zero slippage. Since capital efficiency is calculated using slippage on a trade, this type of trade could be considered infinite capital efficiency if the slippage is zero.

Conclusion

AMMs are one of the best inventions from the Web3 ecosystem. They have democratized market making and changed it from a niche profession to something anybody can do. They also provide a way to list long-tailed assets that might not have been possible in the traditional order book system.

However, like all significant innovations, AMMs can and must be improved further. Their advantages should be increased and deficiencies addressed. Oyster AMM is one such attempt to address some of the deficiencies of the traditional AMM, specifically for the derivatives space.

With Oyster AMM, SynFutures is improving the usability and efficiency of the dApp. We hope you’ll check it out and share your SynFutures V3 experience on X and Discord.

Discover SynFutures' crypto derivative products at www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.