An overview of the DeFi ecosystem and major protocols

Key takeaways:

- DeFi is going mainstream and has gained wide popularity and acceptance in the past year.

- With the DeFi ecosystem continuing to grow, this article takes a brief overview in the following areas with examples: credit & lending (Compound), decentralized exchange (Curve Finance), decentralized derivatives (SynFutures), decentralized insurance (Nexus Mutual)

Introduction

According to DeFi Llama, on Nov. 9th, 2021, the total value locked (TVL) of DeFi reached $275.01 billion, achieving the all-time high (ATM). This record is expected to go higher soon with more and more DeFi activities happening by the minute. Compared to a year ago at around the same time (Nov. 2020), after the meteoric rise of the DeFi sector in 2020 ("DeFi Summer"), the TVL was at around $15 billion. DeFi is going mainstream and has gained wide popularity and acceptance in the past year.

TVL is one of the most widely used metrics in DeFi because it represents the total amount of assets held by each protocol. As a rule of thumb, the more value locked in a protocol, the better it is for the protocol. In most cases, the locked capital is used to offer services such as market making, lending, asset management, and arbitraging across the ecosystem, earning yields for the capital providers in the process.

With such a large amount of capital locked inside the space, various DeFi Dapps have emerged, challenging the norms of financial theories and boundaries. Novel financial experiments are happening daily, giving birth to new projects and categories. Below is a non-exclusive map of the current DeFi ecosystem. Most of the protocols fall into exchanges, derivatives, credit & lending, prediction markets, and stablecoins categories. By the time of writing, credit & lending and exchanges remain the dominant areas in DeFi. One thing to note is that in traditional finance derivative trading has long outstripped spot trading, but in DeFi the derivative market is still relatively small. This trend might change in the future with the market maturing and more derivative DeFi protocols available to suit users’ needs.

In this article, let’s look at some of the major DeFi protocols, one in each of the following sectors: credit & lending, decentralized exchanges (DEX), decentralized derivatives, and decentralized insurance.

Compound

Compound Finance is a money market protocol built by Compound Labs. It is used by crypto investors to lend and borrow digital assets. The protocol is decentralized, Ethereum based, and open-sourced.

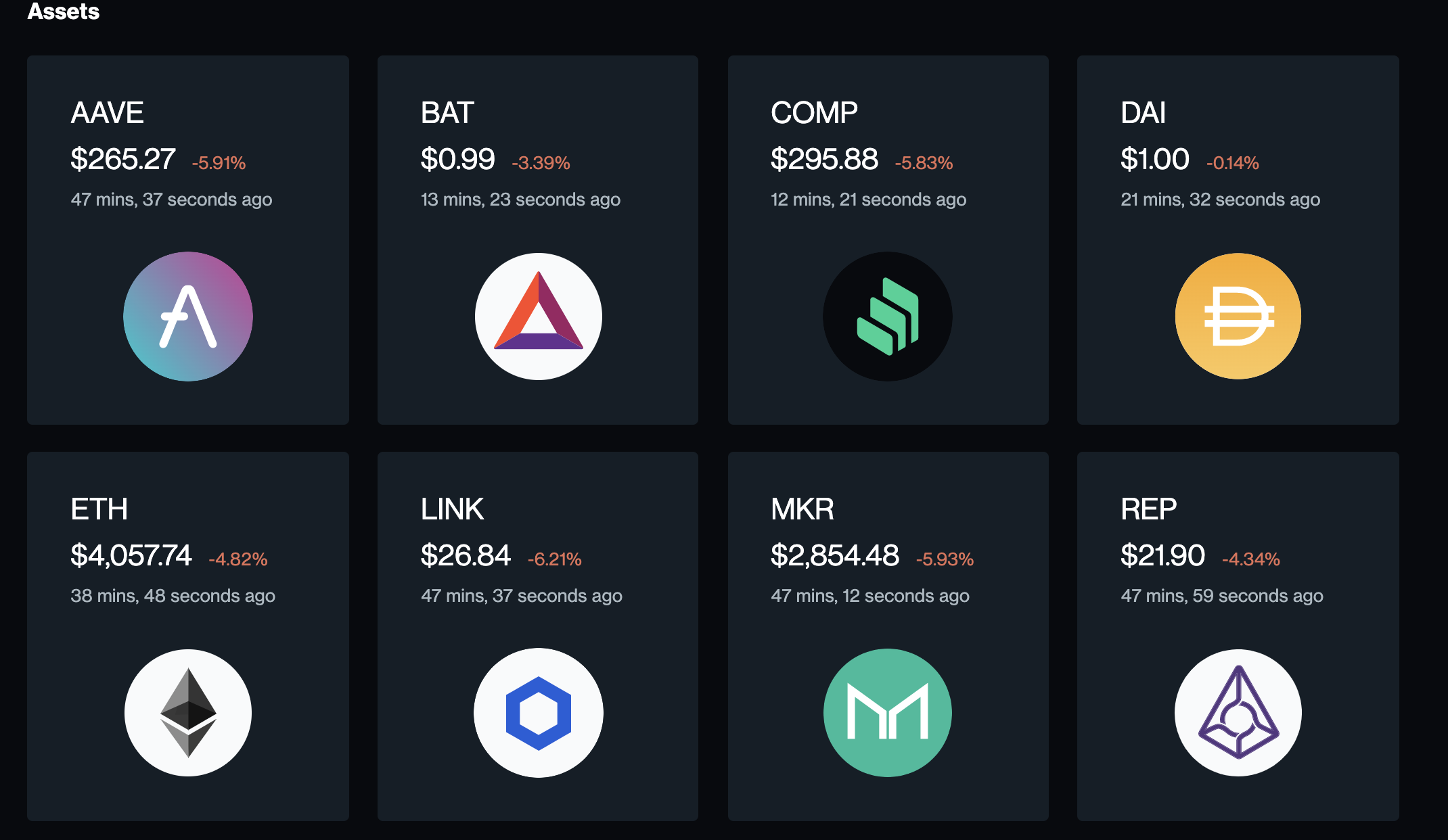

Compound supports the borrowing and lending of a specific set of cryptocurrencies. As of this writing, the assets include:

- Dai (DAI)

- Ether (ETH),

- USD Coin (USDC),

- Ox (ZRX),

- Tether (USDT)

- Wrapped BTC (WBTC)

- Basic Attention Token (BAT)

- Augur (REP)

- Sai (SAI)

- TrueUSD (TUSD)

- ChainLink Token (LINK)

- Aave token (AAVE)

- Maker (MKR)

- Sushi Token (SUSHI)

- Yearn.Finance (YFI)

Anyone with the above assets can deposit them in Compound and start earning interest. The interest earned is denominated in the same asset that one deposits, meaning if users deposit DAI into Compound, they will receive DAI as interest.

On the other side of the equation is borrowing. Users can borrow digital assets once they lock their crypto to compound and use that as collateral. Compound assigns each asset a “Collateral Factor” that determines how much a user can borrow. For example, right now the collateral factor for ETH is 75%. That means if a user supplies 1 ETH as collateral, the user can borrow at most 0.75 ETH worth of other assets at any given time. Each asset has a different collateral factor.

In Compound, interest rates are denoted in Annual Percentage Yield (APY), and the interest rates differ between assets. Compound derives the interest rates via algorithms that take into account the supply and demand of the assets. Essentially, Compound lowers the friction for lending/borrowing by allowing suppliers/borrowers to interact directly with the protocol without needing to negotiate loan terms (e.g., maturity, interest rate, counterparty, collaterals), thereby creating a more efficient money market. In June 2020, Compound introduced its governance token COMP.

Curve Finance

Curve Finance is an AMM-based DEX that offers a highly efficient way to exchange tokens while maintaining low fees and low slippage by only accommodating liquidity pools made up of similarly behaving assets. This is useful in the DeFi ecosystem as there are plenty of wrapped and synthetic tokens that aim to mimic the price of the underlying asset.

Different from many other major spot DEXes, such as Uniswap, Sushiswap, and Pancakeswap which requires liquidity provider to provide an asset pair of equal value, Curve offers multi-asset pools and does not require the asset value to be equal. Liquidity providers can supply one or two or more assets to a pool. The ratio of the assets in the pool is based on the supply and demand of the market. Depositing a coin with a lesser ratio will yield the user a higher percentage of the pool. When the ratio is heavily tilted to one of the coins, it may serve as a good chance to arbitrage.

For example, two of the largest liquidity pools on Curve are both composed of 3 assets. Tricrypto2 pool, consisting of USDT, WBTC, and WETH, is the largest right now, with 3pool consisting of DAI, USDC, and USDT to follow.

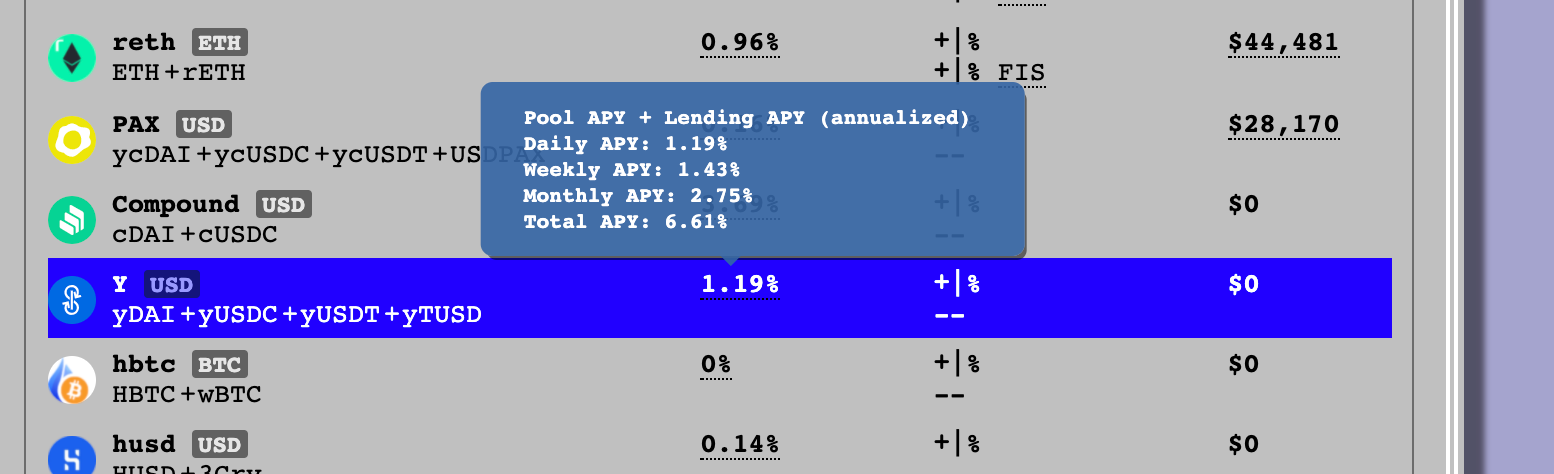

Curve Finance also supports yield-bearing tokens on Compound, Aave, and Yearn Finance. Curve collaborated with Yearn Finance to release the yUSD pool that consists of yield-bearing token yDAI, yUSDT, yUSDC, and yTUSD. Users who participated in this pool will have yield from the underlying yield-bearing tokens, swap fees generated by the Curve pool, and CRV liquidity mining rewards offered by Curve Finance. Liquidity providers of this pool are able to earn from three sources of yield.

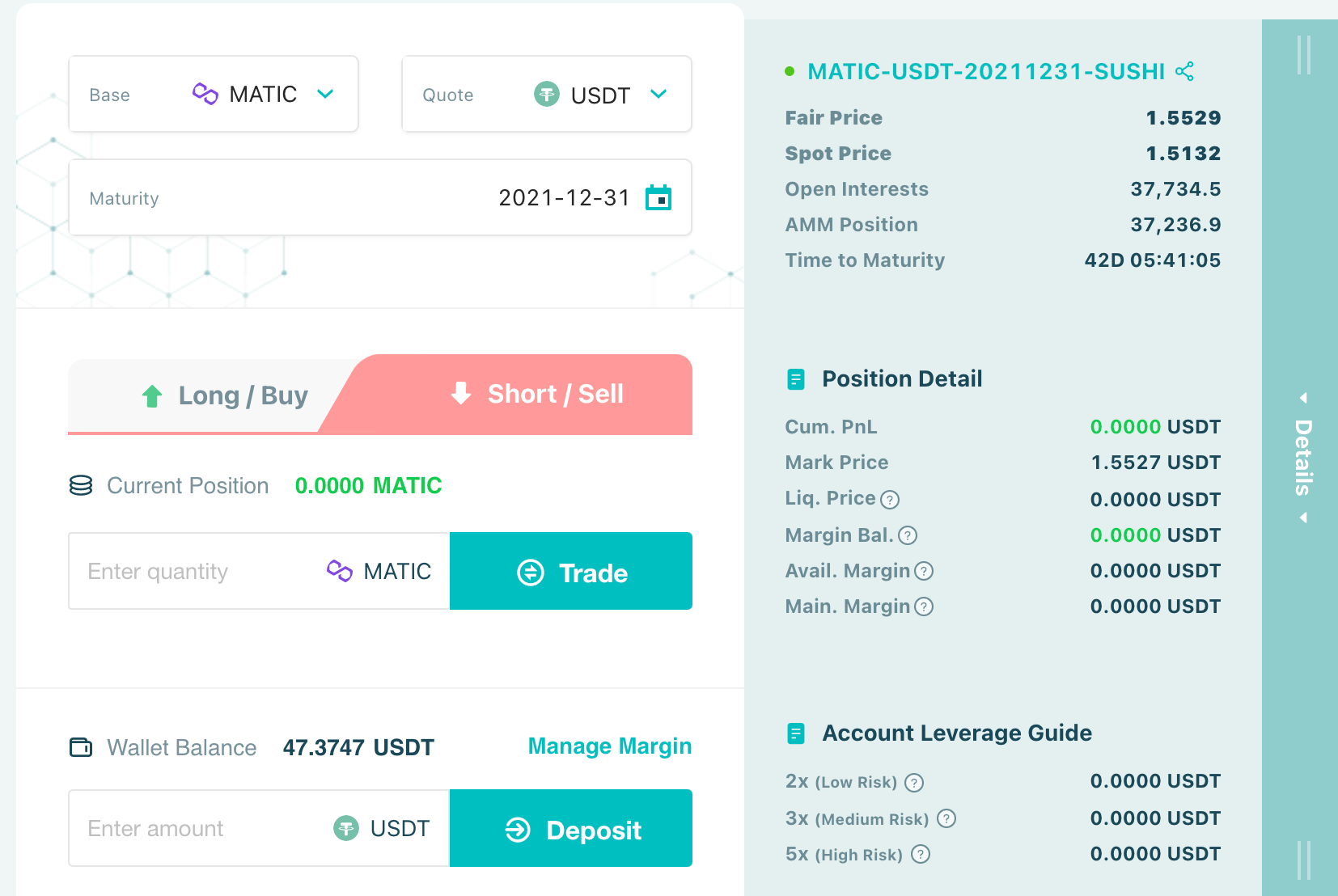

SynFutures

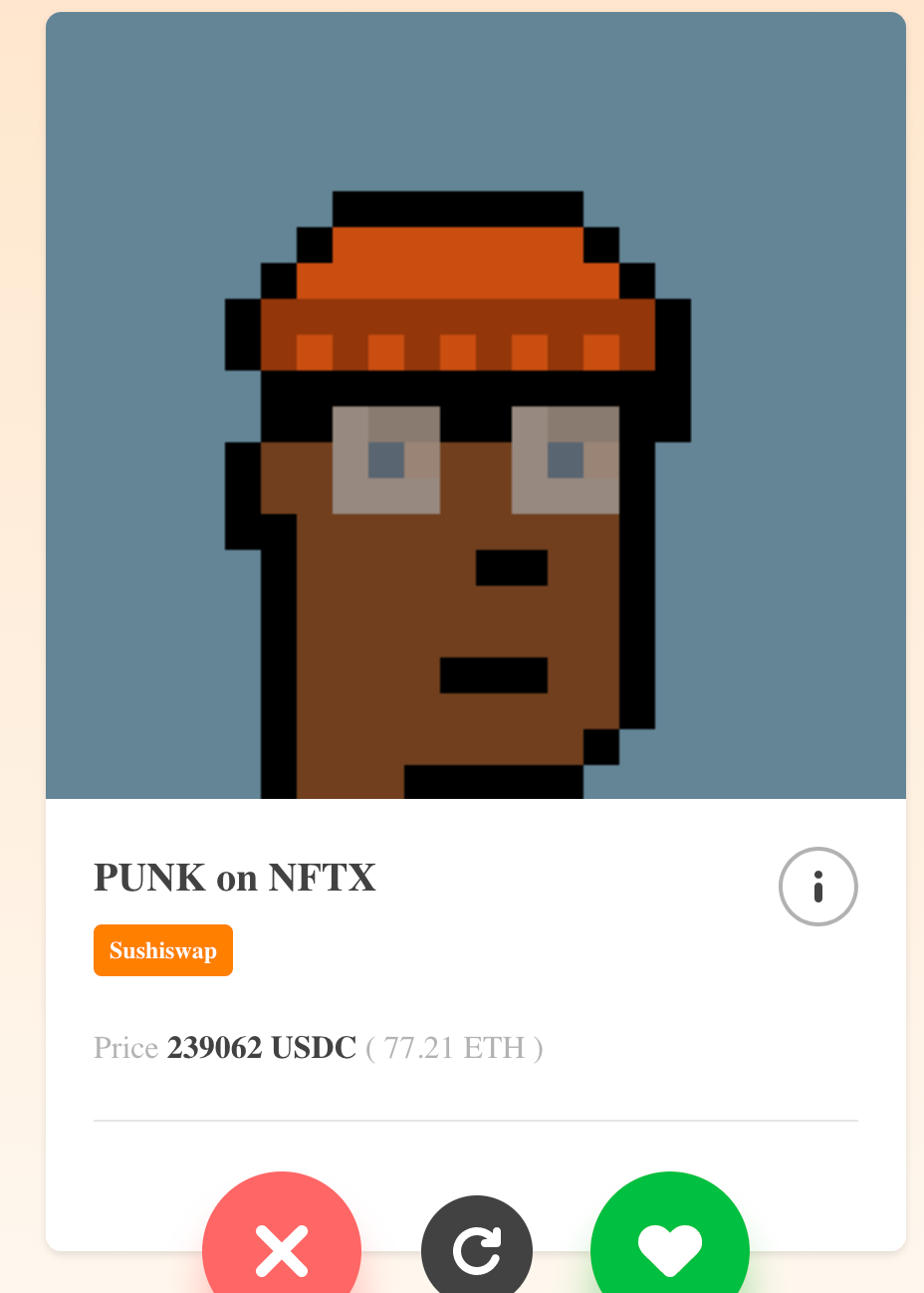

SynFutures is a decentralized futures marketplace that gives users the tools to freely trade any asset with a price feed, whether it be large-cap cryptocurrencies, long-tail digital assets, traditional equities, gold, indices, or NFTs. SynFutures allows anyone with assets to add arbitrary trading pairs with any maturity date and to list their own futures contracts with just a few clicks.

Users can take leveraged long or short positions based on the assets. To protect users’ positions and avoid unintended price volatility that is often seen in the crypto market, such as manipulation of price oracle, SynFutures employs a rigid modeling and risk management system that introduces the best practices in traditional finance to DeFi. In addition, it also has an Automated Liquidator smart contract to perform auto liquidation in cases when users’ positions become insolvent.

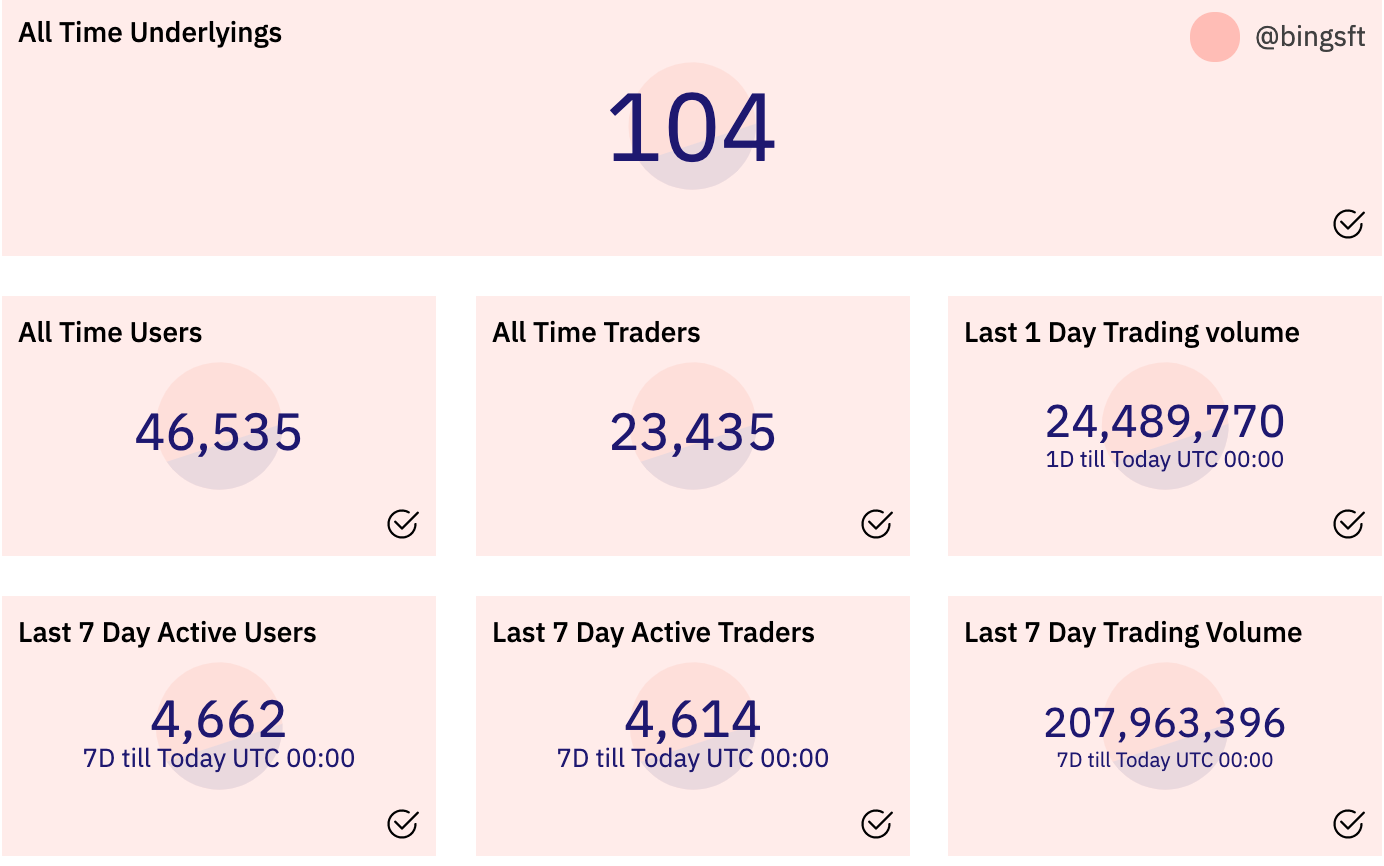

SynFutures launched its v1 protocol in June 2021. With just a few months passing by, it has seen 104 assets being listed on the platform. In July, the protocol released the world’s first fully decentralized hash rate futures allowing users to hedge or speculate on the mining difficulty of bitcoin. Later on, it launched a NFT futures marketplace called NTFures, allowing users to bet on the future price of NFT. According to Dune Analytics (https://dune.xyz/bingsft/synfutures-v1), the protocol is seeing an exponential trading volume growth with 2000 to 3000 daily active traders trading $25M to $32M every day. The accumulative trading volume has reached over $785M at the time of writing.

According to their whitepaper, SynFutures is planning to release a series of innovative new products. This includes an Auto-Hedge, a one-click solution for hedging the “impermanent loss” risk for liquidity providers, and cross margining, a way of offsetting positions to spread and reduce margin requirements.

In traditional financial markets, derivatives trading volume are much larger than that of spot trading, and now the same trend is happening in crypto, especially in centralized exchanges. As decentralized exchanges increasingly gain market share, there is a great opportunity for SynFutures to become the leading futures marketplace. SynFutures has not launched any tokens.

Nexus Mutual

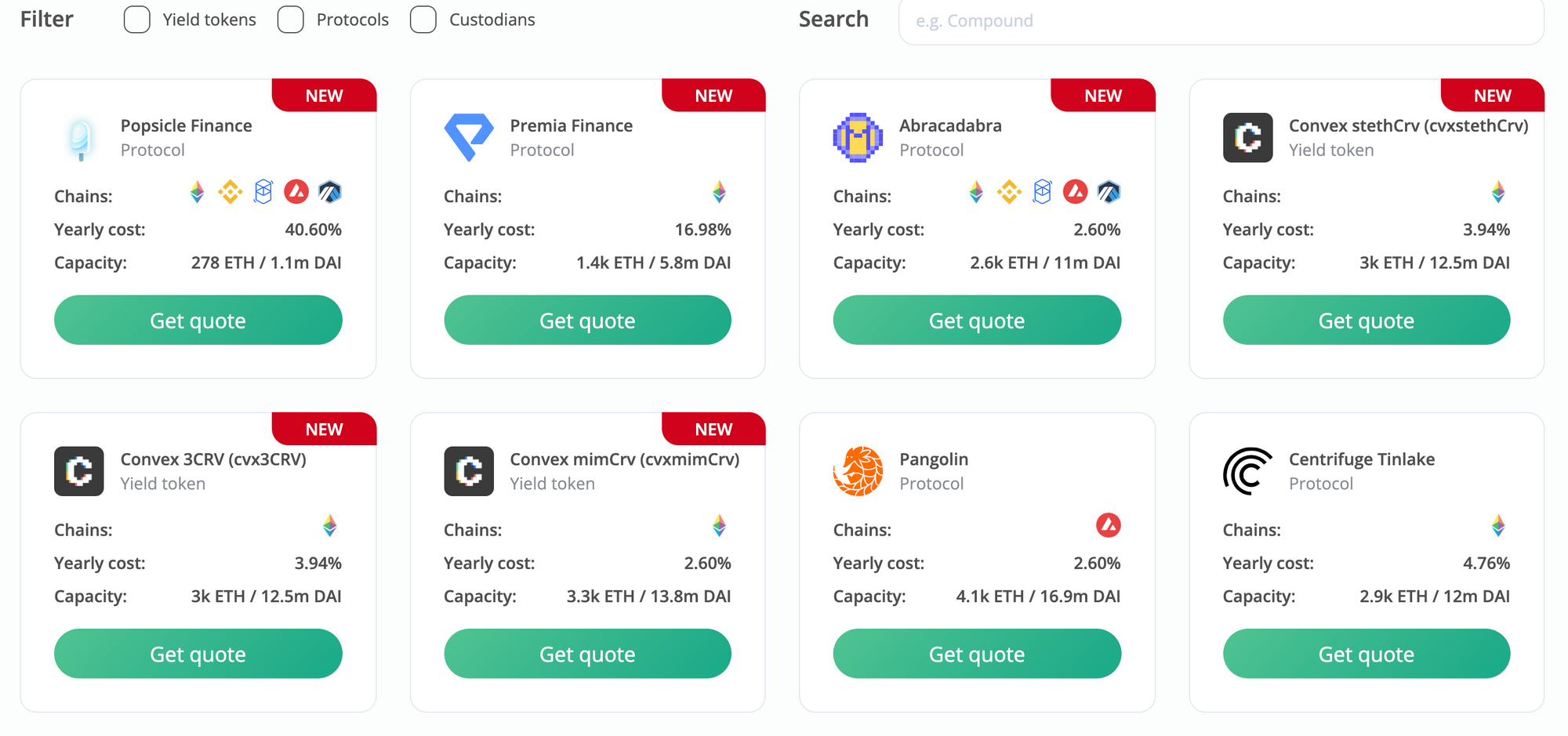

Nexus Mutual is one of the largest DeFi insurance protocols in the crypto market. As of writing, it has a Total Value Locked (TVL) of $700 million (data from DeFi Llama). Nexus Mutual offers three types of covers: protocol covers, custody covers, and yield token covers.

For protocol covers, Nexus mutual covers DeFi protocols that custody user’s funds as these smart contracts may experience hacks due to smart contract bugs. Nexus Mutual offers covers for major DeFi protocols such as Uniswap, MakerDAO, Aave, Synthetix, and Yearn Finance.

For Custody Covers, Nexus Mutual covers the risks of funds getting hacked or when the withdrawal is halted. Nexus Mutual offers covers for centralized exchanges such as Binance, Coinbase, Kraken, Gemini, and centralized lending services such as BlockFi, Nexo, and Celcius.

For yield token covers, Nexus mutual covers failure in protocols that use yield-bearing tokens. It protects the insurer’s value in cases when the yield token de-pegs in value by more than 10%. As of writing, the protocols covered include Convex stetchCrv, Convex 3CRV, Convex mimCrv, Idle DAI v4, Idle USDT v4, Yearn yvDAI v2, Yearn yvUSDC v2, Yearn ycrvstETH v2, Curve 3pool LP, and Curve sETH LP.

Nexus Mutual is structured and governed as an Ethereum-based decentralized autonomous organization (DAO) owned by its members. The Nexus Mutual DAO holds members’ funds in a risk-sharing pool and uses those funds to pay out claims. To buy insurance from Nexus Mutual, users must become a Nexus Mutual member, which allows them to purchase Nexus Mutual’s native token, NXM. NXM can then be used to purchase insurance coverage and to participate in Nexus Mutual’s governance process. NXM’s governance protocol includes the ability to assess the risks of covering particular smart contracts by voting on whether to accept claims, making NXM a multi-faceted utility token that fuels the NXM ecosystem. NXM can only be purchased on the Nexus Mutual platform and is not available on exchanges. Additionally, NXM tokens can only be transferred between Nexus Mutual members. The price of NXM changes in accordance with how much capital the mutual holds, compared to the amount of capital it needs to fulfill its existing liability across claims. The price of NXM increases when the mutual is sufficiently capitalized and decreases when it requires more funds.

Closing

The popularity of DeFi rapidly expanded in 2020 and 2021 and is likely to continue to expand in the years to come as the crypto market matures. The booming market and large capital flew in have incentivized new projects and categories to show up every day and make the DeFi ecosystem more integral. DeFi is transitioning from a space of innovative experimentation to gradually becoming a professional financial operation.

Discover SynFutures' Crypto Derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.