An introduction to DeFi aggregators

Key takeaways:

- DeFi aggregator is a platform that brings together various DeFi protocols and information into one location.

- DeFi aggregators can be categorized into DEX aggregator, liquidity aggregator, yield aggregator, asset management aggregator, and information aggregator

- While aggregators provide many benefits, users should also be aware of the high gas fees that they may come with. DYOR!

What is a DeFi aggregator?

DeFi aggregator is a platform that brings together trading across various DeFi protocols into one location. As the DeFi market continues to boom and expand, new protocols emerge at the time scale of weeks if not days. DeFi protocols are spread out across different blockchains, bringing difficulty for users to find the best protocol to use. DeFi aggregators save the users’ time and increase their efficiency in finding protocols to fit their needs by bringing all the information together.

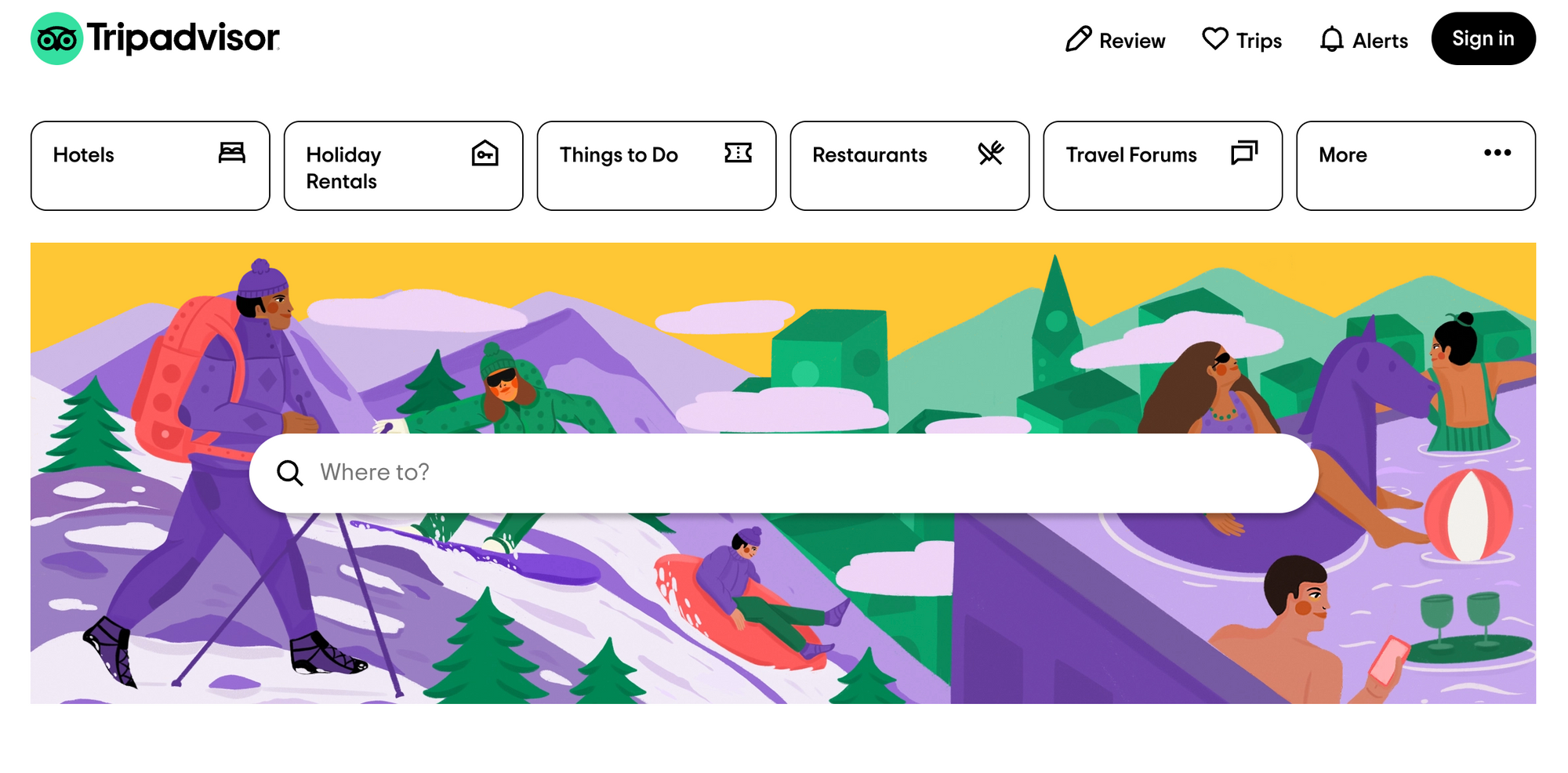

The easiest way to visualize DeFi aggregator is to compare it to a trip search engine. For example, Trip Advisor gets travelers information from various airlines, hotels, vacation packages, car rentals, etc. With Trip Advisor, there is no need for users to log onto each airline or hotel’s website to compare deals and prices. Trip advisor has all the information there for the travelers. DeFi aggregators function in a similar way. They accumulate information from a wide array of DeFi platforms and offer the best possible deals. Not only that, DeFi aggregators give users the option of splitting trades in order to achieve the best possible execution by doing complex calculations that are usually not possible to perform by human beings.

Types Of DeFi Aggregators

Depending on the function, DeFi aggregators can be roughly categorized into DEX aggregator, yield aggregator, asset management aggregator, and information aggregator. Some aggregators have more than one feature.

DEX aggregator

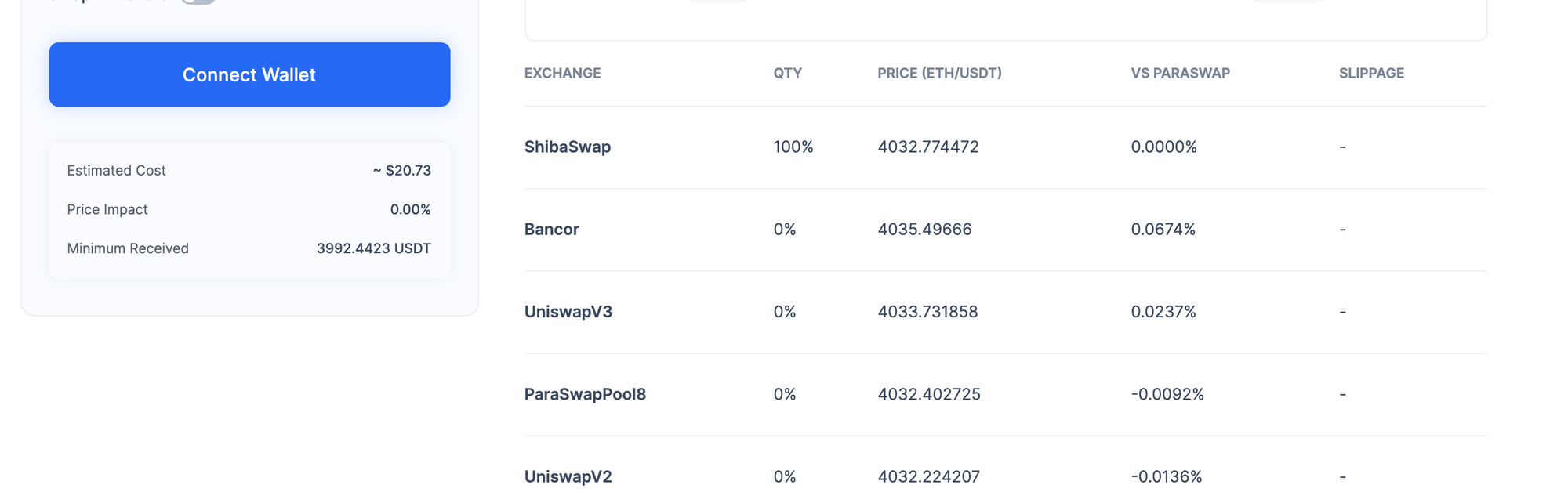

DEX aggregators serve as a unified explorer for prices and liquidity offered in DeFi. Decentralized exchanges offer varying pricing, and it is not always easy to find the best deal for the trading pair you are looking into. Not only that, but crypto investors are also starting to turn more and more to DEXs, as they offer increased security and a better fit with the innate characteristics of a cryptocurrency. The rising interest has inspired more and more DEXs to flood the market, and traders often struggle to find the best possible liquidity and pricing. This is where DEX aggregators come into play. DEX aggregators rely on algorithms to take into account numerous factors in selecting the best possible provider for a given token swap.

For users, it might be natural to seek after the best DEX aggregator when trying to do a swap or trade to get the best price. However, it’s not an easy task to compare them fairly. While users might focus on the quoted price, they are not necessarily reliable, because transaction cost and exchange rate of a pair among different aggregators vary, causing the settle price might be better in one aggregator when the quoted price is worse or vice versa.

In addition, the time difference between approving the exchange and the successful execution of the swap on-chain will affect the final price. During that period, external market forces such as network congestion and the size of selected liquidity pools may change. The DEX Aggregators protocol routing algorithm will also affect the outcome as more efficient transactions reduce network usage and minimize failed transactions. Another point is the size of the transaction. The cost savings incurred from DEX aggregators are proportionally higher for larger transactions because they are more prone to higher price slippage. Smaller transactions may not need to rely on different liquidity pools because a single liquidity pool is the most optimal route.

Therefore, when evaluating a DEX aggregator performance, it’s important to look at all metrics, which include but are not limited to routing algorithm, source of liquidity, current market state, and size of the transaction.

Notable DEX aggregators include 1inch Exchange, ParaSwap, Matcha, MetaMask Swap.

Yield Aggregator

The yield farming process normally requires users to lock up or stake funds, providing variable or fixed ROI in return. Since returns can differ markedly between platforms, it can be exhausting to manually hunt down yield at each platform.

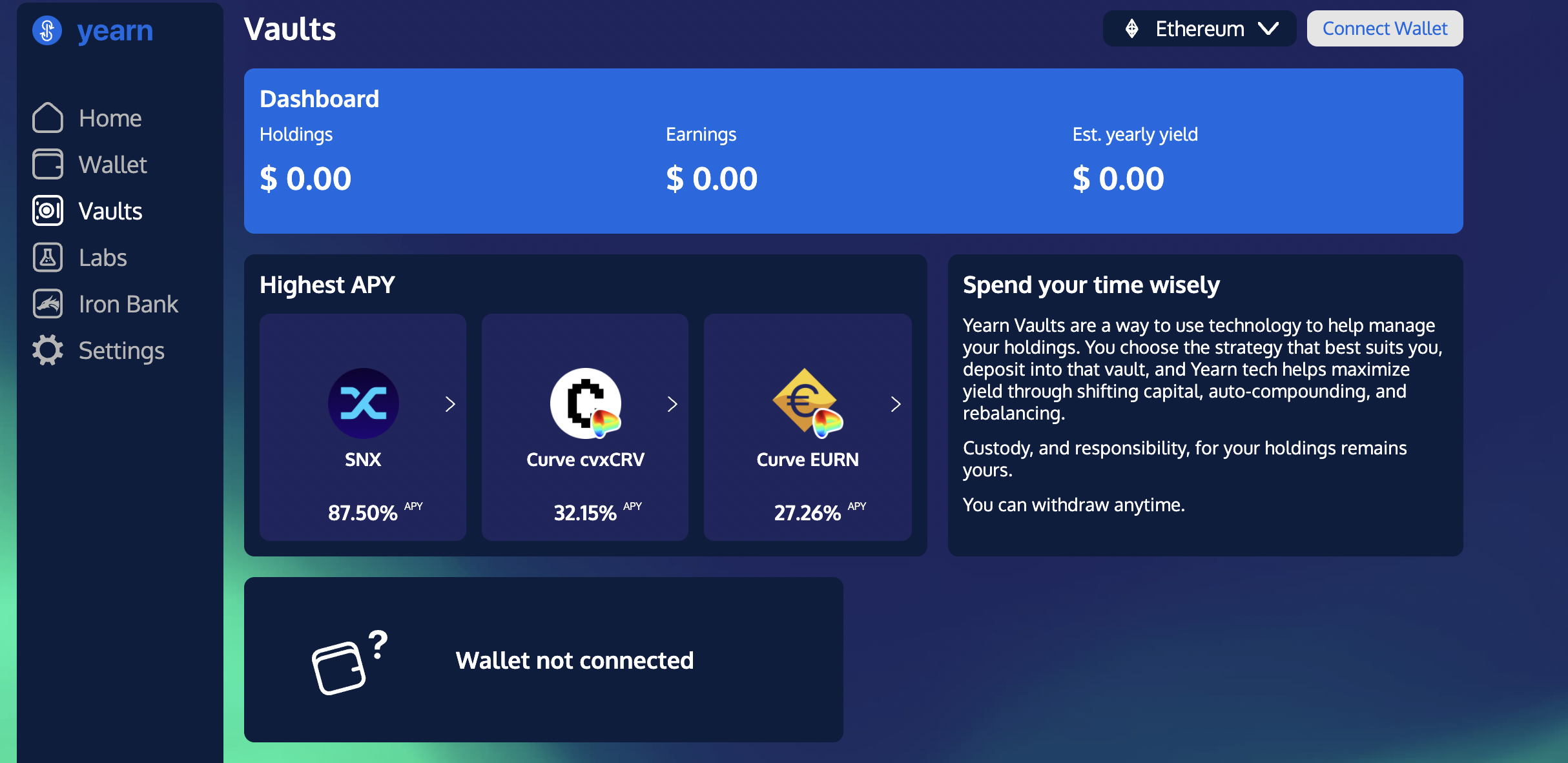

Yield Aggregators introduce functions to automate this process and have been instrumental in the yield farming economy. By leveraging different DeFi protocols and strategies, they simplify the procedure, improve the experience, and maximize profit for users. However, it is alarming that yield aggregators are vulnerable to hacks on platforms which can result in millions of dollars of loss.

Hence, a perfect yield aggregator can not only help investors find out the best yield scheme without tedious manual work but also offer them an attentive and tailor-made risk management strategy.

Notable mentions of yield aggregators include Yearn Finance, Convex Finance, and Rari Capital.

Asset Management Aggregator

In the traditional financial system, a custodian is a specialized financial institution that holds customers' securities for safeguards to prevent them from being stolen or lost. Yet, in DeFi, one is the custodian and also an investment advisor of his/her own funds and assets.

As DeFi continues to mature, more tools are required to seamlessly manage positions across such a wide range of products. Wallets can be seen as the elementary version that enables users to control their funds and interact with decentralized applications. However, for an ambitious asset management aggregator, the aim is to be a one-stop platform for beginners to learn DeFi knowledge and for advanced users to create, managing and track DeFi positions.

Currently, in this space Zapper Finance, DeFi Saver, InstaDapp are worth mention but there is no unicorn. Most platforms are in their early stage. The prospect is hopeful, more so than convenience, making DeFi accessible to rookies through a suite of tools and guides is crucial to crossing the chasm.

Information aggregator

DeFi is spreading out across massive blockchains and within each blockchain, there are different financial protocols. Information aggregators, as the name suggests, aggregate information from various channels into one platform. With the help of such information aggregators, one can track, analyze and discover piles of apps on multiple chains.

Obviously, data retrieval and integration are just the first steps. Each information aggregator has its unique UX/UI design to attract traffic. CoinMarketCap is considered one of the world's most-referenced price-tracking websites for crypto assets. Originally it had daily news and campaigns in the first place, followed by trending coins, biggest gainers, and recently added cryptocurrencies.

DeFi Pulse, another information aggregator, compared to CoinMarketCap, has a simpler and more elegant UX/UI, largely because it has its attention on DeFi market only, rather than the entire crypto market.

Advantages and potential drawbacks of aggregators for users

DeFi aggregators emerged in response to users’ need for simplicity and maximization of profit. While they do bring benefits to users, there are also potential drawbacks that users should be aware of. Let’s look at the benefits and potential drawbacks in the following section.

Convenience

DeFi aggregators siphon the best opportunities and prices from DEXs, lending services, and liquidity pools into one place so users can optimize their trades. Without an aggregator, users need to go to each platform on an individual basis to compare prices that will generate the best deal for them. Then, the user must manually execute each transaction using smart contracts. While this strategy may be fine for casual crypto trading, it severely limits those looking to implement advanced trading strategies.

Not only do aggregators pull the best prices, but some DeFi aggregators even offer a unique, user-friendly way to analyze and combine other users' trading strategies via a convenient drag and drop mechanism. This way, users can create an entirely new strategy of their own using the inspiration of other successful traders. The drag and drop mechanism also help users visualize complex DeFi protocols via blocks that can be built on top of one another.

Better liquidity

DEXs offer a great degree of decentralization, but because they are only emerging on the blockchain market, there are smaller liquidity pools on each of them, especially compared to CEXs. So, a large trading size can move the price considerably (large slippage) or simply be unable to complete the transaction. Thus, pooling several DEXs into one aggregator creates the conditions for better liquidity, thus ensuring that operations occur with fewer liquidity restrictions.

Better Prices

An aspect related to low liquidity is that of slippage. When users trade, they end up buying or selling assets at a price significantly different from the one they planned. When the trading size is large, this difference is quite notable and could make the trade less profitable or lose more. With better liquidity, the price slippage is minimal as even large-scale orders rarely cause dramatic price changes at once.

Better Security

DEXs are much better than CEXs in terms of privacy and confidentiality. Users don’t store their assets in the on-site wallets, thus retaining full control over their possessions and not risking losing everything as a result of a hacker attack.

Better Trading Conditions

Traders conducting operations within one platform are usually limited by the terms present there. So, they mostly need to agree to the current prices rather than go through the hurdles of registering on other platforms. With an aggregator, users always have access to the best price offers on multiple DEXs, choosing where to trade at any given moment and getting the best prices.

Potential drawbacks

The potential downside of using a DeFi aggregator is the gas fees. Usually, gas fees are higher on aggregators compared to using the individual protocol, sometimes over 150% higher. Although some aggregators found solutions to this problem via gas tokens or gas cubes developed into the platforms that let users save money on gas fees, it’s important for users to know this downside and evaluate if the benefits offered by aggregators outweigh the extra gas fees before making trading decisions.

Aggregators beyond DeFi

While DeFi aggregators have emerged and been booming, there are now aggregators which go beyond DeFi and seek to combine both centralized and decentralized exchanges under one roof. Finxflo, based in Singapore, is one such example. Finxflo is a regulated ‘hybrid’ aggregator that allows users to access a breadth of financial services with a single KYC process and wallet. By aggregating the world’s leading exchanges, both centralized and decentralized, it can offer the very best buy and sell prices available anywhere. Finxflo is targeting both institutions that seek regulated solutions as well as general crypto users that want access to professional tools.

Another project, Orion Protocol, also aggregates every CEX, DEX, and swap platform into an easy-to-use decentralized platform. Their mainnet is already live, with early users being able to experience the early functionality of their terminal. Additional features to be added include lending, margin trading, leveraged ETFs, derivatives, contract trading, NFTs, and the staking of any digital asset type.

With both DeFi and CeFi under one roof, aggregators can offer the best of both worlds; greater price choice and liquidity, without demanding its users abandon successful and popular regional exchanges.

Conclusion

DeFi is one of the fastest-growing sectors in crypto and undoubtedly has helped bring people onboard the cryptocurrency market. There are still users who are blocked outside by the sheer number of protocols to choose from and futuristic concepts in DeFi. At the same time, many people simply hold digital assets, rarely participate in financial activities.

With DeFi aggregators, new entries have easy access to make a profit without mastering technical complexities in blockchains. Though aggregation implies centralization in some sense, it's still necessary for the purpose of efficiency. DeFi aggregators combine the non-custodial, anonymous, and transparency features in DeFi with centralized organization strategies to play a key role in this rising market.

Discover SynFutures' Crypto Derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.