Ethereum Network Effects: The Foundation for Decentralized Innovation

In the crypto world, network effects play a crucial role in determining the success and dominance of a particular blockchain protocol. Just as Bitcoin has enjoyed significant network effects that have solidified its position as the primary value store in the crypto space, Ethereum has been steadily building its network effects and has emerged as a strong contender in the blockchain ecosystem. In this article, we will explore the network effects that contribute to Ethereum's growth and discuss its potential to disrupt the value store use case in the near future.

User Adoption and Developer Community

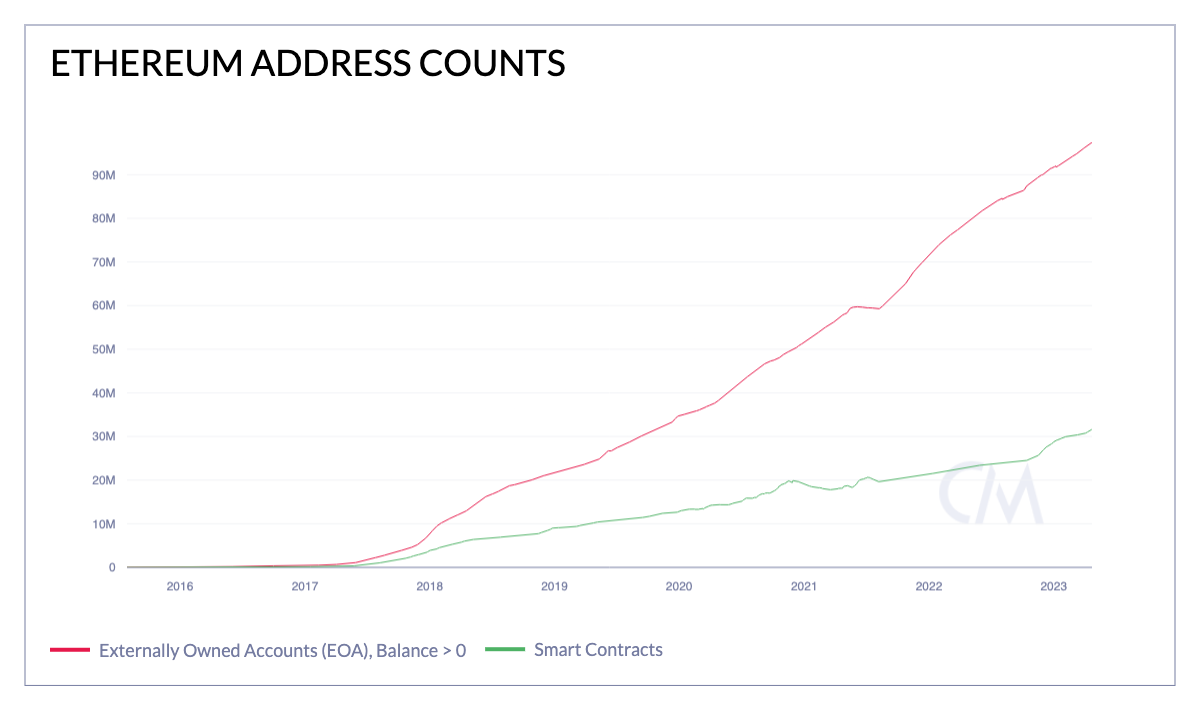

Ethereum has gained substantial traction in terms of user adoption and boasts a vibrant and active developer community. It has become the go-to platform for decentralized applications (dApps) and smart contracts, offering developers a powerful and flexible framework to build innovative solutions. This growing user base and developer community contribute to the network effects of Ethereum, as more users attract more developers and vice versa, creating a positive feedback loop.

Diverse Use Cases and Token Ecosystem

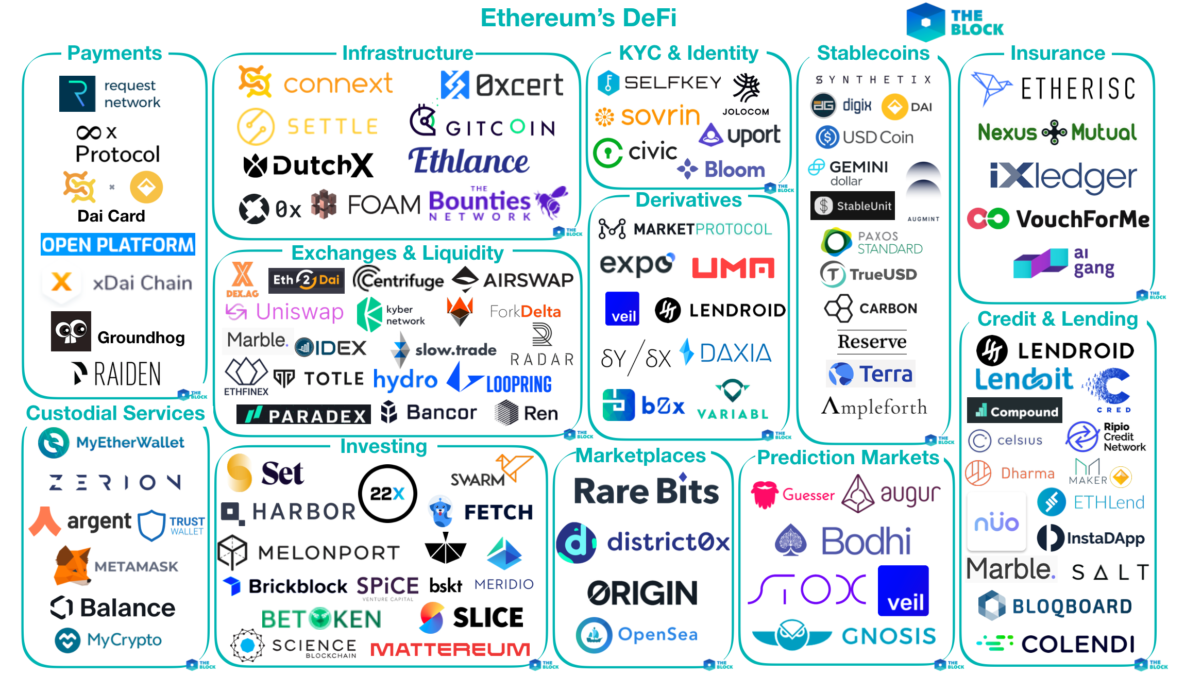

One of Ethereum's key strengths is its ability to support a wide range of use cases beyond being a value store. The Ethereum blockchain enables the creation of custom tokens through its ERC-20 standard, facilitating the emergence of a vast ecosystem of decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and other tokenized assets. This diverse and expanding use case landscape enhances the network effects of Ethereum, as it attracts developers, users, and investors seeking to leverage the platform's capabilities for various purposes.

Interoperability and Composability

Ethereum's compatibility with other blockchain protocols through standards like ERC-20 and ERC-721 allows for interoperability and composability. Developers can build applications that interact with multiple blockchain networks, enabling the seamless transfer of assets and data across different platforms. This interoperability strengthens Ethereum's network effects by connecting it to other blockchain communities and expanding its reach and utility.

Decentralized Governance and Ecosystem Evolution

Unlike Bitcoin, Ethereum embraces a more dynamic and adaptable governance model. The Ethereum Improvement Proposal (EIP) process allows for community-driven decision-making and the implementation of upgrades and innovations. This open and participatory governance structure fosters a sense of ownership among stakeholders, encourages collaboration, and facilitates the evolution of the Ethereum ecosystem. As the network continues to improve and address scalability challenges through upgrades like Ethereum 2.0, its network effects will grow stronger.

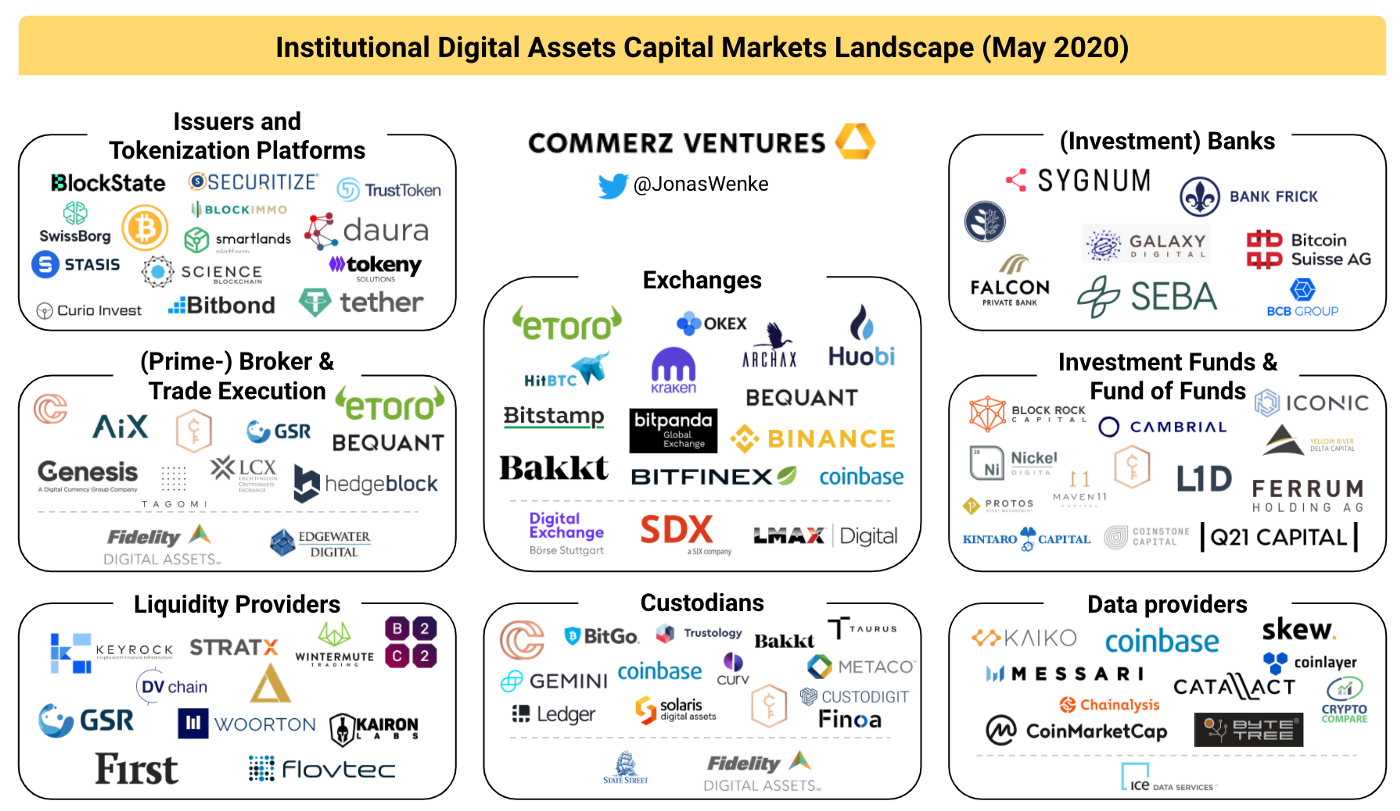

Institutional Adoption and Financial Infrastructure

In recent years, Ethereum has witnessed increasing institutional adoption and financial infrastructure development around its ecosystem. Major financial institutions and corporations have recognized the potential of Ethereum and have started integrating blockchain technology into their operations. Additionally, the emergence of decentralized exchanges (DEXs), lending platforms, and other DeFi services has created a robust financial ecosystem around Ethereum. This institutional adoption and infrastructure development contribute to Ethereum's network effects by attracting more users and investment capital to the platform.

Network Analysis of ERC20 Tokens

Issuance of cryptocurrencies on top of the Blockchain system by startups and private sector companies has become ubiquitous, leading to trading these crypto coins among their holders using dedicated exchanges. Apart from being a trading ledger for tokens, the blockchain can also be observed as a social network. Analyzing and modeling the dynamics of this network's "social signals" can contribute to our understanding of this ecosystem and the forces acting within.

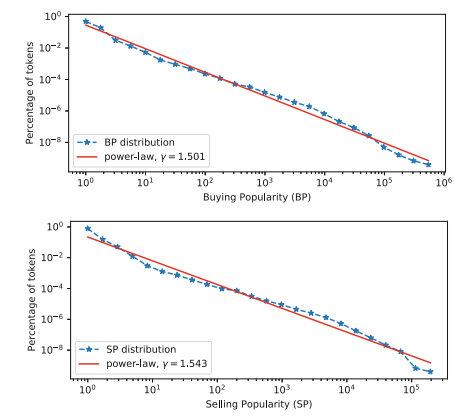

In a recent study conducted by Shahar Somin, Goren Gordon, and Yaniv Altshuler, the network properties of ERC20 protocol-compliant crypto coins' trading data were analyzed for the first time. The study considered all trading wallets as nodes in the network and constructed edges using buy-sell trades. The dataset used in the analysis consisted of over 30 million ERC20 token trades performed by over 6.8 million unique wallets over two years, from February 2016 to February 2018.

The implications of these findings are manifold.

- First, the decentralization and robustness of the ERC20 tokens network contribute to its long-term stability and resistance to external influences. It fosters an environment where innovation and competition can thrive, as no single entity holds disproportionate control over the network. This decentralized nature enhances the trust and confidence of participants in the ecosystem.

- Second, the power-law distribution of token popularity highlights the diverse range of tokens and their associated markets. It presents opportunities for new tokens to emerge and gain traction, as they can attract a non-negligible-sized group of early adopters. This diversity stimulates innovation and the creation of novel applications within the ERC20 tokens ecosystem.

The breakdown reveals that both buying and selling activities follow power-law distribution as seen in the graph above- emphasizing the diversity of token holders and their trading behaviors. While most tokens are traded by a small number of users, there are a few popular tokens traded by a large group of users. This highlights the decentralized nature of the token economy and the potential for new tokens to gain adoption through a non-negligible group of first adopters.

How the network effect impacts the adoption of NFTs

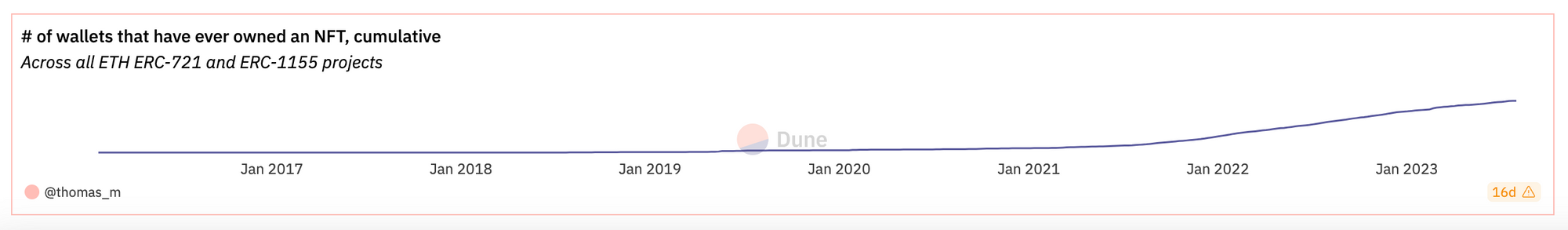

The network effect, a powerful phenomenon in the digital realm, holds significant sway over the adoption and value of nonfungible tokens (NFTs). As the NFT ecosystem expands and more individuals embrace these unique digital assets, the network effect comes into play, enhancing the benefits for each user. This effect stems from the inherent interconnectivity and interdependence that arises within a growing community of NFT users.

With an expanding user base, NFTs gain heightened liquidity and demand. This increased liquidity is particularly advantageous for NFT holders, as it facilitates seamless buying, selling, and repurchasing of these tokens. As more users participate in the NFT marketplace, the depth of the market increases, leading to greater opportunities for transactions and trading.

Moreover, the network effect generates improved opportunities for musicians, artists, and producers to monetize their creations through NFT sales. With a larger user base embracing NFTs, artists can tap into a broader audience and leverage their digital works to generate income. The network effect acts as a catalyst for artists and creators, creating a more conducive environment for their artistic endeavors.

While the network effect plays a pivotal role in driving the adoption of NFTs, it is crucial to recognize that it is not the sole determinant. Other factors, such as usability, security, and the underlying quality of the digital assets, also influence the adoption of NFTs. These factors collectively shape the NFT landscape and contribute to its overall growth and acceptance. Nevertheless, the network effect remains a prominent force, poised to continue shaping the future of NFT development and widespread adoption.

The network effect in DeFi and Web3

The network effect is not exclusive to the realm of nonfungible tokens (NFTs) but extends its influence to decentralized finance (DeFi) and Web3 applications and networks, as well. Within this context, the network effect engenders a cycle of growth and adoption, fueling the value and utility for all participants involved.

Take decentralized exchanges (DEXs) like Uniswap and SushiSwap as examples. These platforms exemplify the network effect in action, demonstrating how increased user activity and participation contribute to their overall value. As more users join these DEXs, the liquidity providers increase, resulting in a virtuous cycle. The growing liquidity pool leads to narrower bid-ask spreads, deeper order books, and more favorable prices for traders. Consequently, this improved trading environment attracts additional users and liquidity providers, reinforcing the network effect.

Beyond decentralized exchanges, the network effect permeates various aspects of the DeFi and Web3 landscape. It stimulates the growth of lending and borrowing platforms, decentralized applications (dApps), and blockchain networks. The expanding network fosters collaboration, innovation, and the emergence of new possibilities within these ecosystems.

By harnessing the power of the network effect, DeFi and Web3 initiatives create an environment where collective participation generates mutual benefits. As more users and activity are drawn into these networks, the value proposition becomes more enticing, encouraging further adoption and engagement. The network effect serves as a cornerstone of the DeFi and Web3 paradigm, propelling the evolution of these groundbreaking technologies.

Looking Ahead: Ethereum's Potential Challenges and Opportunities

While Ethereum has established itself as a dominant force in the blockchain space, it still faces certain challenges and potential threats to its network effects. These include scalability concerns, competition from other blockchain protocols, regulatory uncertainties, and technological advancements in areas such as privacy and scalability.

However, Ethereum's strong network effects provide a solid foundation to navigate these challenges and seize opportunities for further growth. The Ethereum community's commitment to continuous innovation and the network's ability to adapt and evolve are key strengths that will play a crucial role in maintaining its position as a leading blockchain platform.

Conclusion

The network effects of Ethereum are multifaceted and extend across various aspects of the blockchain ecosystem. From user adoption and developer communities to DeFi protocols, developer tools, global collaborations, and token standards, Ethereum's network effects continue to grow stronger. These network effects have positioned Ethereum as a leading platform for decentralized applications, smart contracts, and tokenization. Furthermore, the power-law properties open up opportunities for future research and applications. The robustness of the ERC20 network enables the exploration of techniques for anomaly detection, marketing optimization, cybersecurity, and more.

While challenges and competition persist, Ethereum's solid foundation, adaptability, and commitment to innovation make it a frontrunner in the blockchain space. The platform's vibrant ecosystem, diverse use cases, interoperability, and strong developer community contribute to its network effects by attracting users, developers, and investors.

As Ethereum continues to build on its network effects and address scalability challenges through advancements like Ethereum 2.0 and layer 2 solutions, it has the potential to reshape industries, empower individuals, and revolutionize the way we interact with technology and finance. Ethereum's network effects position it as a transformative force in the decentralized ecosystem, enabling a new era of innovation and decentralization.

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.