Behind the Scenes of Crypto Market Making

Understanding the Mechanics and Implications of Centralized Exchanges

Introduction

Cryptocurrencies have emerged as a groundbreaking financial innovation, disrupting traditional financial systems and introducing a new paradigm of decentralized digital assets. As digital currencies gain widespread adoption, their market dynamics have become increasingly complex, characterized by high volatility, fragmented liquidity, and evolving regulatory frameworks. In this context, market making plays a crucial role in ensuring cryptocurrency exchanges' smooth functioning and liquidity. Understanding the mechanics and implications of market making in cryptocurrency is crucial for anyone seeking to navigate this complex market confidently. We will delve into the intricacies of cryptocurrency market making, exploring the essential concepts, the strategies employed by market makers, and the broader implications for trading. By shedding light on the behind-the-scenes operations, we aim to equip you with a comprehensive understanding of this fundamental component of the cryptocurrency ecosystem.

Fundamentals of Cryptocurrency Market Making

At its core, cryptocurrency market making refers to providing continuous liquidity to a cryptocurrency exchange or trading platform. Market makers are vital participants in the ecosystem, as they bridge the gap between buyers and sellers, ensuring that there is always a market for a given cryptocurrency. The primary objective of market makers is to narrow the bid-ask spread—the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. By continuously offering to buy and sell a cryptocurrency at competitive prices, market makers create a more efficient and liquid market, enabling smoother transactions and reducing price volatility. This process involves deploying sophisticated algorithms and trading strategies to optimize trading volumes and minimize risk. Market makers typically profit from the spread, transaction fees, or incentives exchanges provide. Overall, cryptocurrency market-making fundamentals revolve around enhancing liquidity, improving price discovery, and fostering a stable trading environment.

Decentralized Market Making vs. Market Making on Centralized Exchanges

Decentralized market making and market making on centralized exchanges represent two distinct approaches within the cryptocurrency ecosystem. Decentralized market making operates on blockchain-based decentralized exchanges (DEXs) and relies on smart contracts and liquidity pools. Unlike centralized exchanges, which involve a trusted intermediary to facilitate trading, decentralized market making allows users to trade directly with each other. Liquidity providers lock their funds into smart contracts, which are then automatically used to execute trades based on predefined rules. This decentralized model offers increased transparency, privacy, and control over assets. However, decentralized market making faces challenges such as lower liquidity, limited trading pairs, and potential vulnerabilities in smart contracts.

On the other hand, market making on centralized exchanges involves specialized entities or individuals acting as market makers within a centralized trading platform. These market makers typically have access to advanced trading tools and algorithms, enabling them to offer competitive bids and ask prices to facilitate trading. Centralized exchanges provide a wider range of trading pairs, higher liquidity, and faster execution speeds than DEXs. Market makers on centralized exchanges may have more flexibility in managing risk, adjusting spreads, and accessing order books. However, centralized exchanges are subject to regulatory oversight, potential security risks, and reliance on a trusted third party. To learn more about the differences between centralized and decentralized market making mechanics check out our other article here.

Calculating Risk and Managing Positions for Profitable Market Making on Centralized Exchanges

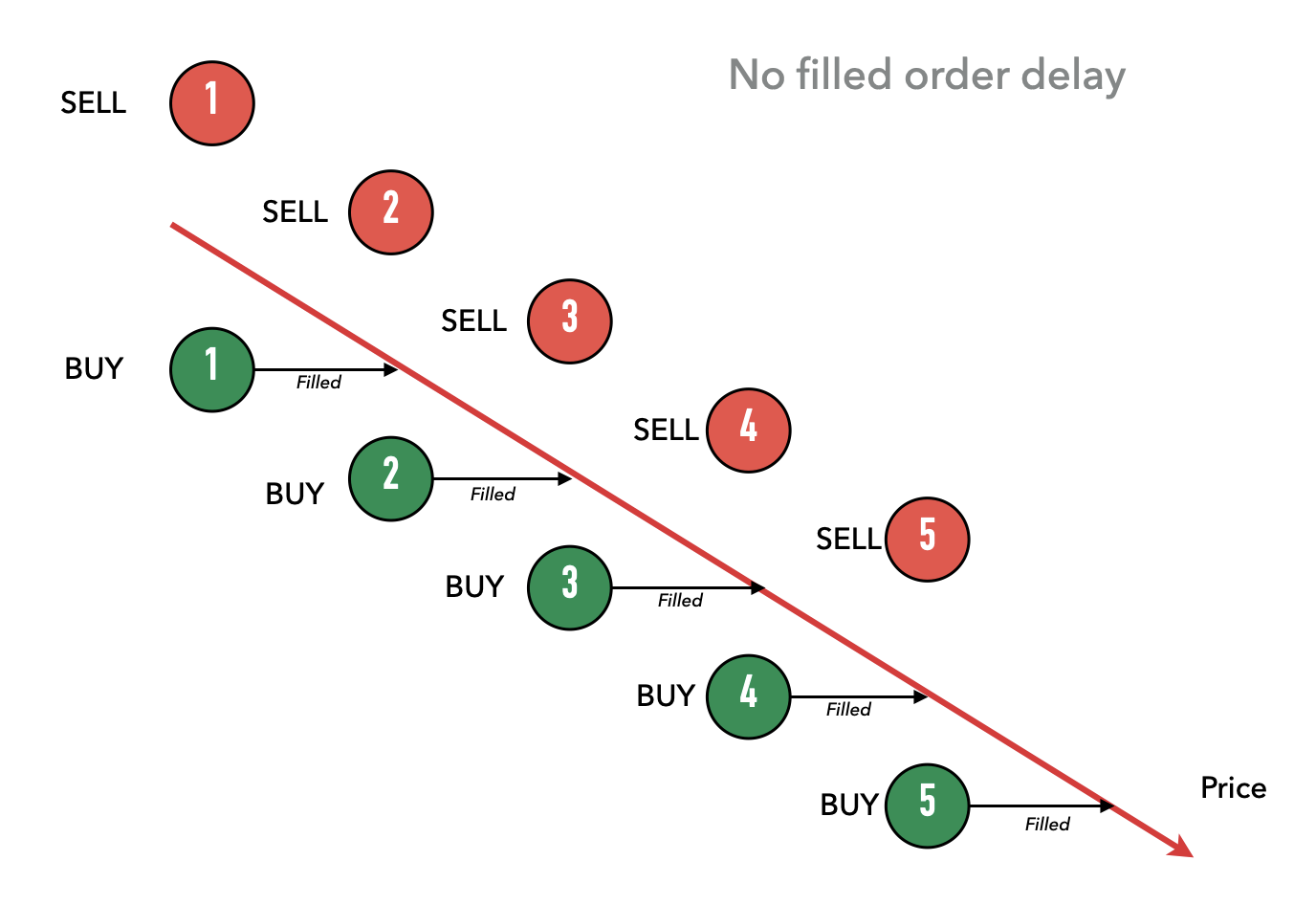

To ensure profitability and minimize the risk of financial losses, market makers on centralized exchanges employ strategic planning and execution techniques. Firstly, market makers carefully analyze the market dynamics, including order books, trading volumes, and price movements, to identify profitable trading opportunities. They leverage sophisticated algorithms and trading systems to identify price imbalances, trends, and patterns that can be exploited for profit. By utilizing these tools, market makers aim to optimize trade execution and reduce the risk of adverse price movements. Moreover, market makers actively manage their order books to maintain a balanced inventory of buy and sell orders. They adjust bid and ask prices based on market conditions, aiming to capture the bid-ask spread while minimizing their exposure to potential losses.

By continuously monitoring and adjusting their order books, market makers can adapt to changing market conditions and control their risk exposure effectively. Market makers also employ risk management strategies to protect themselves from significant fluctuations. This includes implementing stop-loss orders, position limits, and other risk control measures. By setting predefined thresholds and employing risk mitigation tools, market makers can limit their exposure to sudden price movements and mitigate potential losses. Additionally, market makers often engage in hedging strategies to offset potential losses. They may enter derivative contracts or utilize other financial instruments to hedge their positions against adverse market movements. Hedging allows market makers to reduce their exposure to price volatility, helping to safeguard their profitability. Continuous monitoring, analysis, and adjustments are crucial to market makers' strategies. They stay updated on market news, events, and macroeconomic factors that could impact the market. This enables them to react swiftly and make informed decisions to minimize losses and capitalize on profitable opportunities.

Navigating the Incalculable in Market Making on Centralized Exchanges

While market making on centralized exchanges offers numerous advantages, it is not without its inherent risks. One significant risk is the reliance on the exchange itself. Market makers entrust their funds to the exchange, exposing them to potential counterparty risks such as hacking, insolvency, or mismanagement. In the event of a security breach or exchange shutdown, market makers may face the loss of their assets or inability to access their funds. Additionally, market makers on centralized exchanges are subject to regulatory risks, as changes in laws or regulations can impact their operations and profitability. Furthermore, market makers may encounter market manipulation by other participants, such as pump-and-dump schemes or spoofing, which can lead to substantial losses. It is crucial for market makers to carefully assess the credibility, security measures, and record of accomplishment of the exchange before engaging in market-making activities. Implementing robust risk management strategies, diversifying trading activities across multiple exchanges, and staying informed about regulatory developments are essential to mitigate the risks associated with market making on centralized exchanges.

Conclusion

Cryptocurrency market making, whether on centralized exchanges or decentralized platforms, is crucial in facilitating liquidity and stability within the digital asset ecosystem. Through the continuous provision of bid and ask prices, market makers enhance trading efficiency and contribute to price discovery. While market-making on centralized exchanges offers advantages such as higher liquidity and access to a broader range of trading pairs, it is not without risks. These risks include counterparty risks, regulatory uncertainties, and the potential for market manipulation. Nevertheless, market makers mitigate these risks through strategic planning, sophisticated algorithms, risk management techniques, and hedging strategies. Market makers must carefully assess the risks associated with their chosen platform, stay informed about market dynamics, and adapt to changing conditions to maximize profitability while minimizing potential losses. By understanding the mechanics and implications of market making, traders and investors can confidently navigate the cryptocurrency market and make informed decisions in this dynamic and evolving landscape.

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.