Perpetual Futures vs. Lending Protocols for Increasing Crypto Exposure

Introduction

The cryptocurrency world is constantly evolving, and investors are always looking for new ways to increase their exposure to digital assets. Two strategies that have gained popularity in recent years are using perpetual futures and lending protocols.

Perpetual futures allow investors to speculate on the future price of cryptocurrencies without actually owning them, while lending protocols provide investors a way to increase exposure by borrowing more cryptocurrency against their assets. However, as with any investment strategy, these methods have associated costs. Decentralized and centralized options both have their unique benefits and drawbacks.

In this article, we’ll explore these strategies in depth and evaluate the costs of using decentralized and centralized perpetuals and lending protocols to increase crypto exposure.

Leveraging Perpetual Futures for Greater Crypto Exposure

Regarding trading perpetual futures, the maximum leverage ratios can vary depending on the platform. Some platforms may offer leverage ratios as high as 100x, while others offer lower ratios. It's important to note that higher leverage ratios also come with higher risks, as even a small price movement in the wrong direction can result in significant losses.

In addition to leverage ratios, perpetual futures have funding rates that can affect a trader's position. Funding rates are the costs paid by traders who hold positions open past a certain period, usually eight hours or more. The funding rates can either be positive or negative, depending on the demand for the contract. Positive funding rates mean that long position holders pay short position holders and vice versa for negative rates. These funding rates are calculated and paid regularly, usually every eight hours. As a result, traders who hold positions over longer periods may be subject to several funding payments, which can add up and lead to principal reduction.

Furthermore, if a trader's account balance falls below the required margin level due to a principal reduction, the trader's position may be liquidated. This can happen unexpectedly and result in significant losses for the trader. Therefore, when trading perpetual futures, it's essential to keep an eye on the funding rates and understand how they can affect your positions.

Traders should also be mindful of their maximum leverage ratios and take steps to manage their risk by using stop-loss orders and other risk management tools. By doing so, traders can maximize their exposure to the crypto market while minimizing their risk of significant losses. To learn more about perpetual futures, you can see our article here.

Using Lending Protocols to Boost Crypto Exposure: Pros, Cons, and Best Practices for Maximizing Gains

Decentralized lending protocols have become increasingly popular in the cryptocurrency space as they provide an alternative way for traders to gain leveraged exposure to cryptocurrency assets. These platforms offer a more accessible and flexible way to borrow funds than traditional lending platforms, with lower fees and fewer restrictions. To use a decentralized lending protocol, a trader must deposit the cryptocurrency asset they wish to use as collateral. They can then borrow stablecoins against their collateral and use the borrowed funds to purchase more of the cryptocurrency. The trader can also choose to keep their position open for an extended period, allowing them to potentially earn more profits if the cryptocurrency's value continues to rise.

However, traders must be aware of the risks involved in using these lending protocols. Interest rates on borrowed funds can quickly add up, and if the value of the cryptocurrency asset being used as collateral drops significantly, the trader may be forced to sell their collateral at a loss to cover the loan. Additionally, the protocols may have specific liquidation thresholds and ratios that need to be met to avoid unexpected liquidations.

The Price of Leverage: Assessing the Costs of Using Lending Protocols for Increased Returns

One important aspect to consider when using a decentralized lending protocol to gain leveraged exposure to cryptocurrency assets is the required loan-to-value (LTV) ratio. The LTV ratio is the ratio between the value of the collateral deposited and the value of the loan being taken out. The higher the LTV ratio, the more leverage a trader can obtain. However, different lending protocols have different LTV ratio requirements, and traders may be limited in the amount of leverage they can obtain.

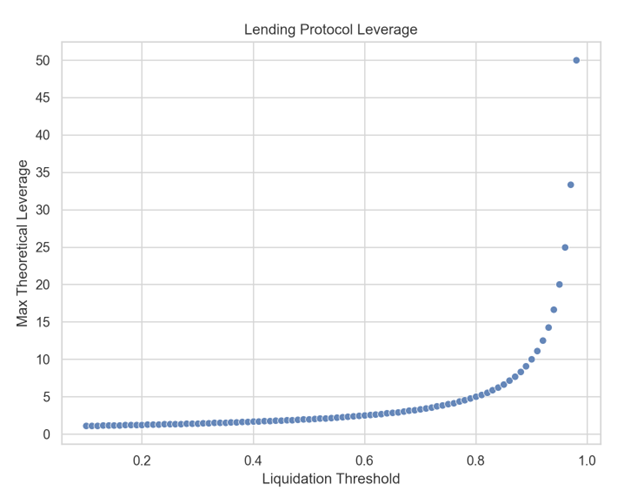

For example, if a protocol has an LTV requirement of 50%, a trader can only borrow up to 50% of the value of the collateral they deposit. The following graph shows the theoretical amount of leverage that can be obtained using this method based on the LTV ratio required by the lending protocol. As the LTV ratio increases, so does the amount of leverage that can be obtained. It's important to remember that higher leverage also comes with higher risks, and traders should carefully consider their risk tolerance before using this method.

Traders should also be aware of the different types of interest rates offered by the lending protocols. Some protocols offer variable interest rates, which fluctuate depending on market conditions and demand for the cryptocurrency asset. Others offer fixed interest rates, set when the loan is taken out, and remain the same throughout the loan term. It is essential to carefully consider which type of interest rate to choose, depending on market conditions and risk tolerance.

Overall, decentralized lending protocols offer traders a flexible and accessible way to gain leveraged exposure to cryptocurrency assets. However, traders should exercise caution, monitor their positions closely, and have a clear understanding of the risks involved. By doing so, traders can take advantage of the benefits of these protocols while managing their risk and minimizing the potential for unexpected liquidations.

Conclusion

In conclusion, perpetual futures and decentralized lending protocols offer traders a way to gain leveraged exposure to cryptocurrency assets. Which method is best depends on various factors, including the current market conditions, the desired level of leverage, and the trader's risk tolerance. Perpetual futures are an attractive option for traders seeking high leverage levels and the ability to hold positions for extended periods. However, traders need to be mindful of funding rates, which can add up quickly and result in unexpected losses. Additionally, perpetual futures are settled in cryptocurrency, which may not be desirable for all traders. On the other hand, decentralized lending protocols can offer a more flexible and accessible way to borrow funds, particularly when interest rates are low, and maximum LTV ratios are high. These protocols can also provide a more secure alternative to holding stablecoins. However, traders need to be aware of the risks involved, including the potential liquidation of collateral if the value of the collateral drops significantly or if the interest rates on the loan exceed the profits made from the investment.

Ultimately, traders should carefully consider their options and choose the best method for their investment goals and risk profile. By doing so, traders can gain leveraged exposure to cryptocurrency assets while minimizing their risk of significant losses.

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.