NFT Investing: Longing vs. Shorting NFTs

NFTs have gained immense popularity in the last three years and have become the first blockchain product to gain the most mainstream attention since Bitcoin. These distinctive digital assets allow users to own and trade one-of-a-kind pieces of artwork, music, fan merchandise, and other similar items. Apart from being collectibles, they can also serve practical purposes, such as in P2E games, digital identity, and more. As such, they quickly became a favorite investment opportunity for many in the crypto ecosystem.

However, like any other investment, NFTs come with their own risks as well as opportunities. The price of an NFT can shoot up at a short interval and crash back down after a certain period. This volatility allows traders to trade these assets and try to make money through short-term positions. This article will discuss how some traders can long and short NFTs using NFT derivatives platforms like NFTures. Investors can also use these tools to hedge their position in this volatile market.

What Does Long and Short Mean?

Before we dive deep into the benefits of using NFT derivatives, we must first understand what long and short refer to in trading. Long and short are two opposite investment strategies that traders use to make a profit from market movements. In simple terms, long traders buy an asset derivative hoping its price will increase, while short traders sell an asset derivative hoping its price will decrease.

Let’s look at an example: Alice and Bob are interested in the BoredApe NFT collection. Alice believes its price is likely to go down, while Bob believes it’s likely to go up. Alice could then post collateral (say $500) and take a $1,500 short position on BoredApe with 3x collateral. Bob could post the same amount and take a similar long position. Depending on how the price of the BoredApe collection moves, Alice would make money, and Bob would lose it, or Alice would lose money, and Bob would gain it. As we can see, using derivatives allows traders to make money even when the price of the underlying asset is going down. This opens many trading opportunities as traders can now play both sides of the market.

Longing or shorting derivatives is a popular trading method for every other form of asset. There are already derivatives for stocks, currencies, commodities, and cryptos. With the launch of NFTures and other similar platforms, NFT derivatives are slowly gaining mainstream adoption as well.

Using NFT Derivatives to Hedge Risk

NFT derivatives trading is not only an avenue for making profits by taking short-term positions. It can also be used by long-term investors to hedge their positions and protect themselves from massive price swings that often happen in the NFT market. To understand how this works, let's go back to the previous example; say Alice also owns a CryptoPunks NFT that she believes is currently overvalued, and she is concerned that the price will drop in the future. But she also doesn't want to sell her NFT outright because she believes in its long-term potential. Normally, this would leave her with the only option of hodling for the long term, but with derivatives, she now has another option. Instead of just hodling, she can hodl the NFT while also short the futures contract of the same CryptoPunk. Doing this would allow her to profit if the price of the NFT falls and thereby offset any loss that she might have incurred from holding the NFT itself.

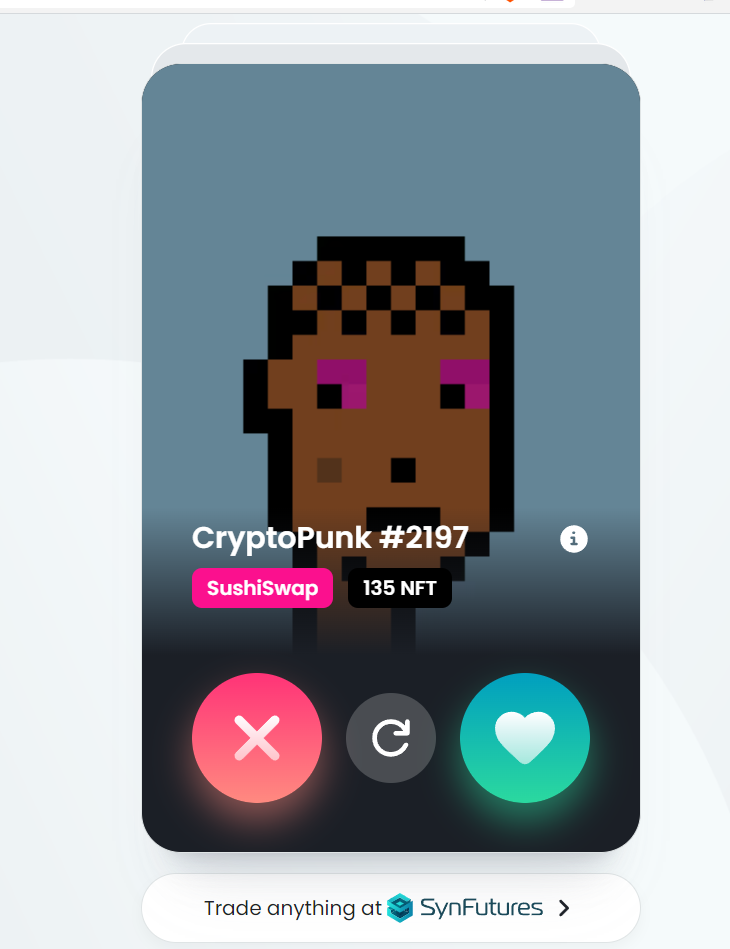

Let’s say CryptoPunks is currently trading at $110,000, and Alice expects the price to drop to $100,000 in the near future. She can then go to NFTures, connect her wallet, and short the CP futures contract at the current price by tapping the ‘X’ button. NFTures interface is designed to be as simple as possible to create a smooth user experience.

If the price of the NFT drops to $100,000, Alice can close her position and pocket the profit. Because she used derivatives to hedge her position, even though the price of her NFT dropped by 10%, Alice’s portfolio value continues to stay the same.

Shorting NFT derivatives can be a useful tool for investors to manage their risk and protect their NFT investments against potential price fluctuations, as long as they have a clear investment strategy.

Conclusion

NFT investing offers significant opportunities for investors to diversify their portfolios and potentially earn high returns. However, like any other investment, it comes with its risks. NFT derivatives offer investors more strategies that they can use to manage these risks and potentially earn a profit.

To be successful in NFT investing, it's important to have a good understanding of the underlying concepts and principles. So before jumping into derivatives trading, an investor must understand some of the basics of NFTs, their real-world use cases, and different NFT platforms and products. Understanding the basics of NFTs and then using derivatives has the potential to become a highly profitable NFT investment strategy.

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.