Exploring the Relationship Between NFT Prices and ETH Prices

Digital assets have witnessed a revolutionary development in recent years with the emergence of non-fungible tokens (NFTs). NFTs have gained significant attention, allowing unique digital items to be bought, sold, and owned securely on the blockchain. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has become the primary blockchain platform for NFTs due to its robust smart contract capabilities.

This article aims to explore the relationship between NFT prices and ETH prices, employing statistical methods such as Pearson correlation and several other models to gain a comprehensive understanding of their interplay.

Understanding NFTs and ETH

Before delving into the relationship between NFT prices and ETH prices, it's crucial to grasp the basics of NFTs and Ethereum. NFTs are digital assets that represent ownership or proof of authenticity for a specific item or piece of content, such as artwork, collectibles, music, or virtual real estate. These tokens are indivisible, unique, and cannot be exchanged on a one-to-one basis like cryptocurrencies.

Ethereum, on the other hand, is a decentralized blockchain platform that enables the creation and execution of smart contracts. ETH serves as the native cryptocurrency of the Ethereum network, used for transactions, gas fees, and interactions with decentralized applications (dApps) and NFTs.

Analyzing the Relationship: Pearson Correlation

The Pearson correlation coefficient is a statistical measure that quantifies the strength and direction of the linear relationship between two variables. In this case, we can analyze the correlation between NFT prices and ETH prices to understand their interconnectedness.

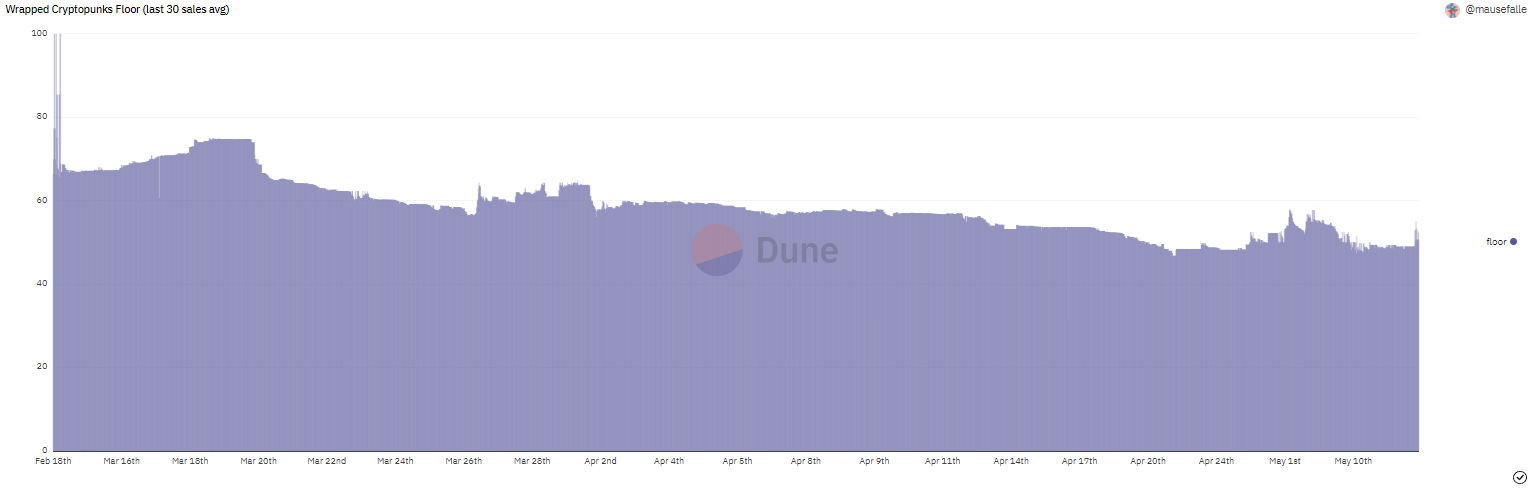

To perform the analysis, historical data for both NFT prices and ETH prices needs to be collected. This data can be obtained from various platforms and marketplaces specializing in NFT trading. Once we have the data, we can calculate the Pearson correlation coefficient, ranging from -1 to 1. In our case, we will perform this using the CryptoPunks floor.

If the correlation coefficient is close to 1, it indicates a strong positive correlation, suggesting that as the price of ETH increases, NFT prices also tend to rise. Conversely, if the coefficient is close to -1, it implies a strong negative correlation, indicating that as ETH prices increase, NFT prices tend to decrease. A correlation coefficient near 0 signifies a weak or no linear relationship between the two variables.

Correlation Analysis

A crucial aspect of our study involves examining the correlation between ETH prices and the prices of various NFT categories, including art, collectibles, and virtual real estate. This analysis provides insights into the degree of linear association between these two asset classes.

The findings revealed a positive correlation between ETH and NFT prices, indicating a general tendency for their values to move in the same direction. As the price of ETH increases, the prices of NFTs also tend to rise, suggesting a positive relationship between these two markets.

However, it is important to note that the strength of the correlation varies across different NFT categories. This implies that the relationship between ETH and NFT prices may not be uniform across all segments of the NFT market. Factors such as market dynamics, demand-supply imbalances, and investor sentiment can influence specific NFT categories differently, leading to variations in the correlation strength.

For instance, while art-related NFTs might exhibit a strong positive correlation with ETH prices due to their popularity and market demand, collectibles or virtual real estate NFTs may show a relatively weaker correlation. Understanding these nuances is crucial for investors and market participants to develop targeted strategies and make informed decisions within the NFT space.

Moreover, the correlation analysis also allows us to observe potential trends and patterns in the relationship between ETH and NFT prices over time. By examining historical data, we can identify periods of increased correlation or instances where the correlation deviates from the overall trend. These observations can provide valuable insights into the evolving dynamics of the Ethereum-NFT ecosystem.

It is essential to consider that correlation analysis measures only the degree of linear association between ETH and NFT prices. It does not establish a causal relationship or provide information about the underlying factors driving the correlation. Therefore, further analysis is required to explore potential causal links between ETH and NFT prices, which we address through our causality analysis.

ETH and CryptoPunks Analysis

In addition to exploring the correlation between ETH and various NFT categories, we conducted a focused analysis on CryptoPunks, one of the most iconic and sought-after NFT collections. By examining the selling prices of CryptoPunks and their relationship with ETH, we aimed to gain deeper insights into this specific NFT segment.

To gain further insights, we divided the CryptoPunks collection into three groups based on their price range, specifically the first, second, and third quarter of the floor prices. The floor price represents the lowest available price at which a CryptoPunk can be purchased at a given time. By examining these different price segments, we aimed to observe any distinct patterns or variations in the relationship between ETH and CryptoPunks prices.

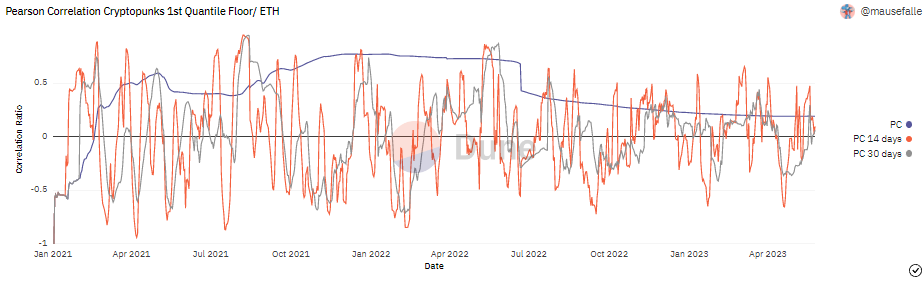

First Quarter of the Floor Prices

In the analysis of the first quarter of the floor prices, we observed a strong positive correlation between ETH and CryptoPunks prices. As the price of ETH increased, so did the prices of the cheaper CryptoPunks. This finding suggests that there is a significant demand for more affordable CryptoPunks when ETH prices are on the rise. Investors seeking entry into the CryptoPunks market may turn to the lower-priced options during such periods.

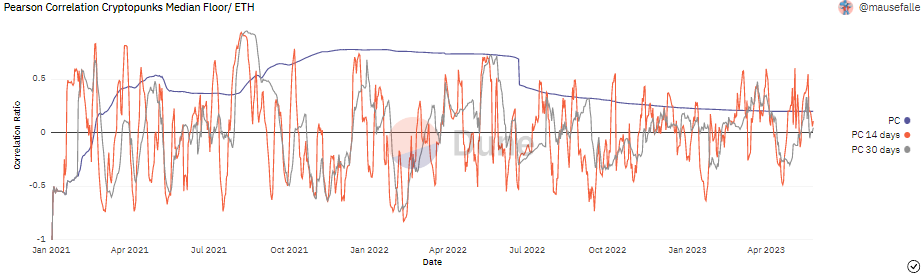

Second Quarter of the Floor Prices

The analysis of the second quarter of the floor prices revealed a moderate positive correlation between ETH and CryptoPunks prices. While the correlation was not as strong as in the first quarter, it still indicated a tendency for the prices of mid-range CryptoPunks to move in line with ETH prices. This suggests that as ETH prices rise, there is a corresponding impact on the value of mid-priced CryptoPunks.

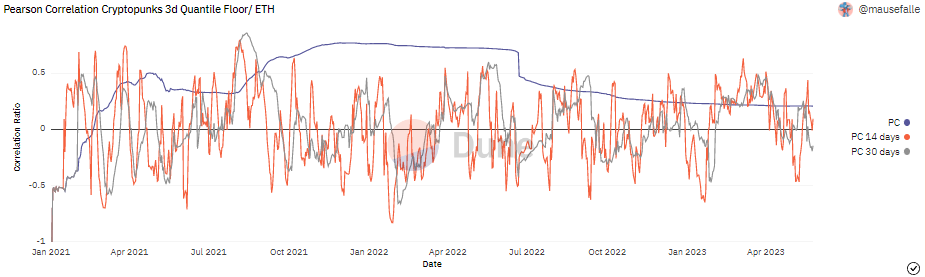

Third Quarter of the Floor Prices

In the analysis of the third quarter of the floor prices, we found a relatively weaker positive correlation between ETH and CryptoPunks prices. This suggests that the relationship between ETH and the prices of higher-priced CryptoPunks is not as pronounced as in the lower and mid-price segments. Higher-priced CryptoPunks may be influenced by other factors such as rarity, desirability, and specific demand patterns within the CryptoPunks market, which could attenuate the direct impact of ETH price movements.

This focused analysis on CryptoPunks provides valuable insights for investors and collectors interested in this particular NFT collection. Understanding the relationship between ETH and CryptoPunks prices across different price segments can aid in strategic decision-making and identifying potential opportunities within the CryptoPunks market.

It is essential to note that while these findings are specific to CryptoPunks, they contribute to the broader understanding of the correlation dynamics between ETH and NFTs. Further research and analysis may be required to explore the relationship between ETH and other NFT collections in a similar segmented manner, enabling a comprehensive examination of various NFT categories and their connections to ETH prices.

Conclusion

The analysis conducted in this study focused on exploring the correlation and causality between Ethereum (ETH) and non-fungible token (NFT) prices, with a specific emphasis on the popular CryptoPunks collection. By examining historical price data and dividing CryptoPunks into different price segments, we aimed to gain insights into the relationship between ETH and NFT prices.

Overall, our findings indicate a positive correlation between ETH and NFT prices, suggesting that as the price of ETH rises, the prices of NFTs, including CryptoPunks, tend to follow a similar upward trend. However, it is important to note that the strength of this correlation varies across different NFT categories and price segments.

When specifically analyzing the CryptoPunks collection, we observed different correlation patterns based on the price range. In the first quarter of the floor prices, which represents cheaper CryptoPunks, we found a strong positive correlation between ETH and CryptoPunks prices. The second quarter, representing mid-priced CryptoPunks, showed a moderate positive correlation, while the third quarter, representing higher-priced CryptoPunks, exhibited a relatively weaker correlation.

These insights highlight the significance of considering various price segments within NFT categories when assessing the relationship between ETH and NFT prices. Different price tiers may be influenced by distinct factors such as rarity, desirability, and specific demand patterns within the NFT market, which can affect the correlation dynamics with ETH prices.

Understanding the correlation and causality between ETH and NFT prices has practical implications for investors, collectors, and market participants. It provides insights for investment strategies, risk management, and portfolio diversification within the Ethereum-NFT ecosystem. Moreover, monitoring the relationship between ETH and NFT prices can help inform decision-making and identify potential opportunities in specific NFT categories, including collections like CryptoPunks.

While this study focused on CryptoPunks, further research is needed to analyze the relationship between ETH and other NFT collections in a segmented manner. Additionally, it is crucial to acknowledge that correlation does not imply causation, and external factors such as market sentiment, regulatory developments, and technological advancements can influence the relationship between ETH and NFT prices.

In conclusion, the exploration of the correlation and causality between ETH and NFT prices, along with the specific analysis of CryptoPunks, contributes to our understanding of the interdependencies and dynamics within the Ethereum-NFT ecosystem. Continued research in this area will enhance our comprehension of the evolving relationship between ETH and NFTs, providing valuable insights for stakeholders in the digital asset space.

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.