Key takeaways:

- DAO stands for Decentralized Autonomous Organizations whose governance is based on all of its members who can vote on things that need implementation, not on just the selected few.

- DAOs inscribe rights and responsibilities that a corporation or organization typically manages to smart contracts, which are deployed on the blockchain. Therefore, DAOs decisions are immutable.

- Despite the benefits of DAOs, there are drawbacks too. The technology is still in its very early stage and will need to mature and be widely adopted in an extensive range of applications.

Introduction

By relying on peer-to-peer philosophy and “smart contracts” on the blockchain, DeFi democratizes the financial market and replaces traditional centralized institutions such as banks, brokerages, and market makers. Smart contract technology eliminates human intervention and is at the core of DeFi. However, smart contracts are essentially a series of codes that can be altered by developers. You might wonder who is deciding whether and how the codes should be changed – meaning who decides the future of these DeFi applications?

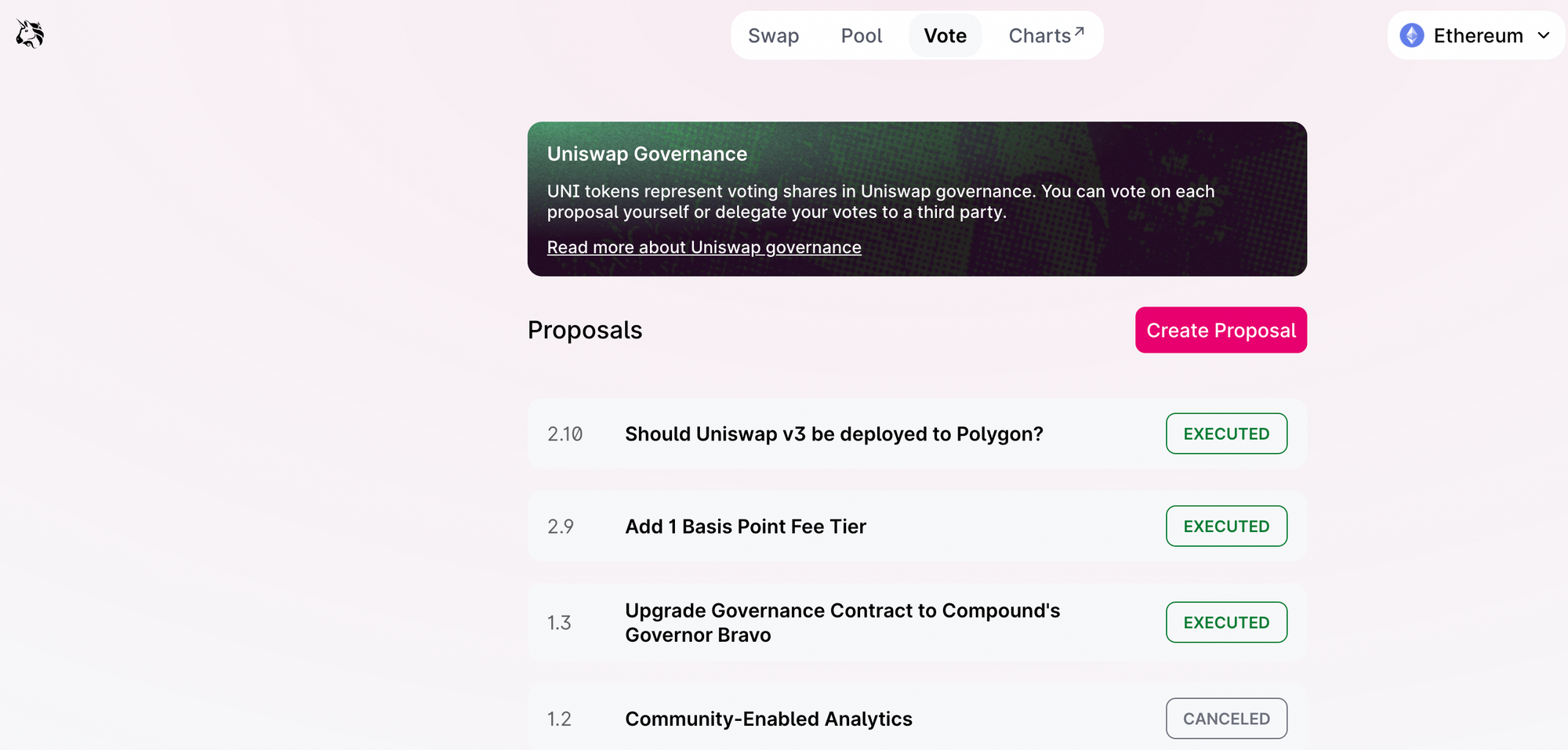

Most of the major DeFi applications, from Uniswap to Aave to MakerDAO, are now governed by DAOs, a term that stands for Decentralized Autonomous Organization.

DAOs are governing bodies that oversee the allocation of resources tied to the projects they are associated with and are also tasked with ensuring the long-term success of the project. Unlike the traditional companies and organizations where the governance is mostly based on executives, board of directors, investors and etc, DAOs’ governance is based on all of its members who can vote on anything that needs implementation. This makes DAOs’ operation fully transparent.

Now we have a good idea of what DAOs are, the next question is…

How do DAOs operate?

The way DAOs operate vary. To make it easy to understand, let’s use the most widely adopted framework in DeFi as an example to explain.

DAOs inscribe rights and responsibilities that a corporation or organization typically manages to smart contracts. Members of the DAOs use tokens to vote on the rules of the protocol or system.

To initiate changes, anyone who holds a certain number of tokens can suggest changes to the protocol or system. These proposals can be technical or non-technical. For example, Compound’s Proposal #74, which sought to adjust three total parameters across three Compound assets, was recently passed by Compound’s DAO and got executed. The other example - Uniswaps Proposal #2, which called on Uniswap to reward their users with UNI, is more ideological.

After a suggestion has been successfully proposed, the governance token holders vote on if they are “for” or “against” the proposal. A DAO usually has its own quorum requirements. If the quorum is met, the proposal gets passed; otherwise, rejected.

If a proposal gets passed, it typically goes in the queue on the developers’ to-do list. The project developers make changes to the smart contract, and the changes will eventually reflect the proposal.

The above summarizes how DeFi DAOs are typically operated so far. Projects like SynFutures use project NFTs instead of governance tokens to determine the voting powers of its DAO (Alpha phase) members. Each DAO has some core differences just like each democracy around the world varies in how they execute democratic principles. There are distinct levels of checks and balances within the different DAOs.

How to launch a DAO?

Technically, a DAO launch typically occurs in three major steps.

Smart contract creation: A developer or a group of developers must create the smart contract, which is basically a chunk of codes, behind the DAO. After the smart contract is launched, the rules can only be changed by the smart contract through the DAO governance system.

Funding: A DAO typically requires funding to make the system work. After the smart contract has been created, the DAO needs to determine a way to receive funding and how to enact governance. Often the funding is raised through token sale, and the sold tokens give holders governance power.

Deployment: Once everything is set up, the DAO needs to be deployed on the blockchain. From this point on, stakeholders decide on the future of the project. The project team who creates the project and wrote the smart contract no longer influence the project more than other stakeholders.

DAOs beyond DeFi

The first-ever DAO created was The DAO. The well-known The DAO was founded in 2016 and it was intended for venture capital funding. It successfully amassed $150 million in crowdfunding in May 2016 but was hacked and drained of $50 million in cryptocurrency weeks later.

Although the money was restored by hard forking the Ethereum blockchain, people’s trust in DAOs was undermined. The interest in DAOs was renewed with the explosion of DeFi in 2020 and today the list of DAOs is extensive. DAOs are being used for many purposes, such as investment, fundraising, borrowing, or buying NFTs.

Many analysts and industry insiders affirm that DAOs are coming to prominence, even potentially replacing some traditional companies. Some projects are looking to achieve complete decentralization through the DAO model, but it’s worth pointing out that DAOs are only a few years old and have yet to achieve their final goals and objectives.

Disadvantages of DAOs

Although DAOs have many benefits, they are not perfect. They are still a new technology that has attracted much criticism.

Among all, the most notable criticism is their lack of legal personhood which prevents them from owning property or entering into contracts in most jurisdictions. Regulation on DAOs can be tough since no entity can be responsible for a DAO’s decisions, making the law ambiguous for DAOs.

Another drawback of DAOs is that the implementation of development updates and bug fixes are going to be more challenging since no single entity can make the decision, and every decision is immutable. DAOs have to enter into voting for every single change, and this could impede the development of blockchain technology.

In addition, DAOs reply on the validity of the code deployed on the network. The mathematical certainty and irrevocability of smart contracts may not require people to act honestly, but not everyone can find loopholes in their code which can be vulnerable itself too.

Last but not least, DAOs are meant to be for average users, shifting global power in all sorts of ways back to the average people, but the reality is that venture capital firms and other powerful investors can easily rule the day. Big names like A16z, Framework Ventures, Three Arrows Capital, among others can receive significant stashes of the governance tokens for sheeling out billions to the DeFi projects like MakerDAO and Compound. More governance token typically means more voting power, simple math.

Closing

With the many benefits of DAOs, they are not perfect. However, just because they have problems doesn’t mean DAOs shouldn’t exist or overcome these problems in the future. As the development continues, the legal construction of DAOs matures, and the platform as a whole improves, DAOs could usher in an era where every person is part of decentralized firms.

Discover SynFutures' Crypto Derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles except for SynFutures, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.