Key Takeaways

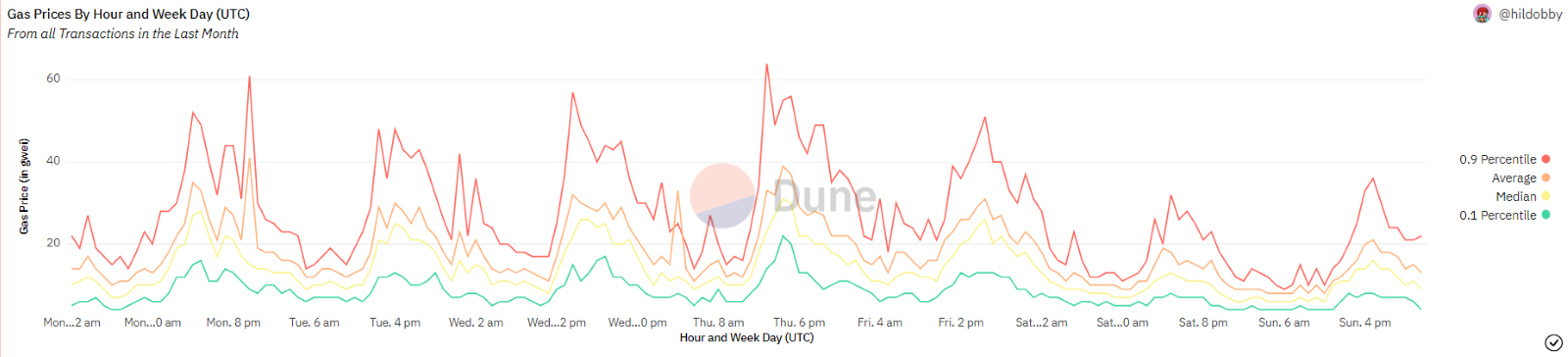

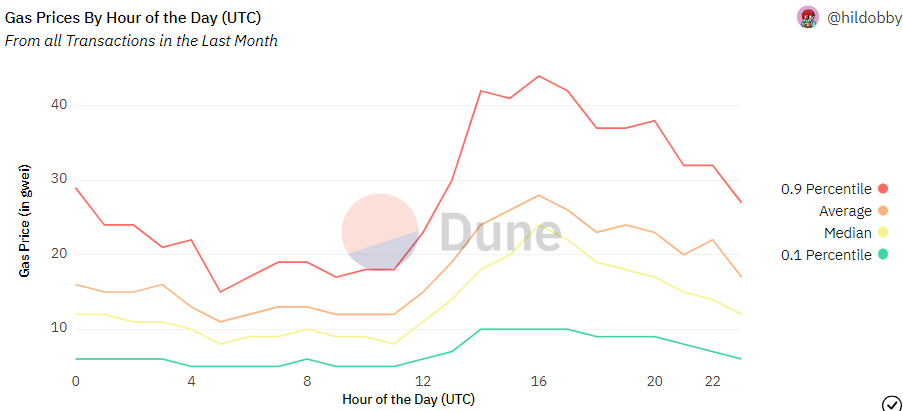

- Gas prices vary between days of the week and hours of the day on a predictable level.

- Transactions with a low priority or ones that can be planned (e.g., deposits and withdrawals) should be executed during less-crowded timeframes.

- Transactions on the Ethereum blockchain are mostly aligned with the American East Coast.

The Ethereum Ecosystem is the most influential and most used blockchain ecosystem other than Bitcoin. Transactions on the Ethereum network incur fees. However, the amount is flexible and can be set freely. This is the so-called gas price. To learn more about Ethereum gas, check out this SynFutures Academy article.

Gas fees are nothing more than transaction fees that apply to all transactions made on the blockchain. Unlike the Bitcoin blockchain, where all transaction fees are charged at a fixed rate, Ethereum gives you a free choice. However, your decision has an impact on the transfer duration.

Three things determine the price of gas:

- The current price of Ethereum.

- The complexity of the transaction being processed.

- The number of transactions currently taking place.

- The size of the smart contract that will be executed.

The classic supply and demand market principle also applies to the Ethereum gas price. ETH is currently struggling with little demand, which strongly affects price development. The gas limit is currently at 15 million GWEI per block. This allows more transactions to be processed in each block, causing the statistical demand value to drop. But falling demand is not the only reason for the current record low.

The Ethereum gas pricing mechanics work on a pay more, pay first basis. The more GWEI you are willing to give away, the more incentives are offered to process your transaction faster. So-called arbitrage bots voluntarily pay more gas to push their decentralized exchange transactions through as quickly as possible. However, these transactions are now moving to a parallel chain on the Ethereum blockchain. This circumstance also leads to falling gas prices.

The Time Zone Factor

The gas price can be set lower to save Ether on the transaction. However, should the price be too low, including this transaction in the block is no longer attractive, and the transaction will never be executed. If the gas price is set higher, it will be more attractive to include the transaction in the current block, and the transaction will be executed faster. With the gas price, you can determine how fast a transaction is to be executed should it be executed. If it is a significant transaction, a high gas price is selected; if it is an unimportant transaction, a lower gas price can be selected.

To put it simply, there are big crowd effects at work. On one side, there are basic users who don’t need their transactions processed immediately; on the other, they need to have their transactions processed as quickly as possible (e.g., when minting tokens, etc.).

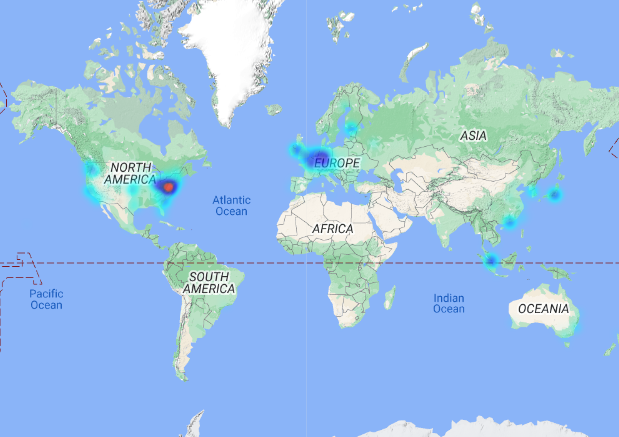

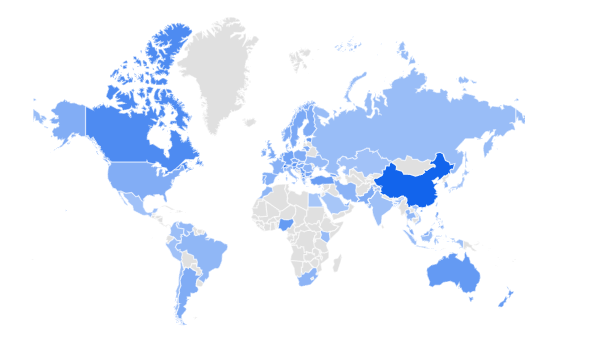

So, the first step for reducing the gas cost is to time a transaction when there are fewer users. The Western Hemisphere and East Asia dominate the ETH Mainnet Nodes showcase activity.

However, a look at the Google search volume paints a different picture, as most of the activity is centered in Asia and the USA, with Europe playing a less significant role. Based on this information, we can assume some power usage hours around the Chinese and American time zones, with less activity in the European ones.

However, there is a factor often overlooked: There is a massive time gap between the Pacific time zones, from UTC –9 to UTC +9 or from Alaska to Japan, where there is no big, populated country. Hence, the East Coast's gas fees tend to shoot up around 6 to 7 a.m.

The Intraday Seasonality

So what does this mean for intraday statistics?

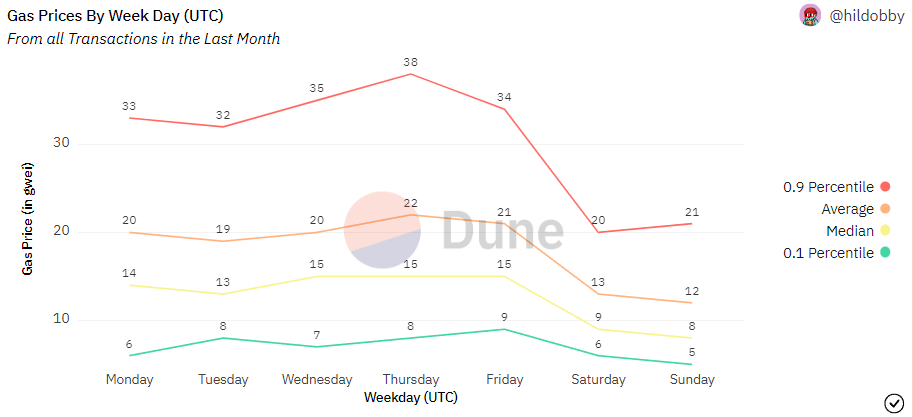

There are certain days and periods when the network receives fewer transactions, resulting in lower Ethereum fees. When are Ethereum gas fees the lowest? Interestingly the gas price usually surges at 12 UTC (6 am EST) and peaks in the afternoon UTC (9-12 am EST), which suggests that most transactions are aligned with the American East Coast.

The Intraweek Seasonality

Also, it's important to keep in mind that most transactions are done in the U.S., Europe, and Asia. Historically, Saturdays and Sundays are the days when gas rates are lower because not everyone works weekends. This results in transaction costs on the weekends being as much as half of the ones during peak mid-week trading days.

Gas Wars

Like the frequent conflicts over scarce resources such as land, fossil fuels, and precious metals, there are also regular battles in the blockchain sector. These are referred to as gas wars. As they are usually timetable, the gas wars are part of the seasonality of crypto by forming events with extreme price volatility.

In a gas war, different network participants fight to secure space on the next block by participating in a "priority gas auction" (PGA). It's about paying more for gas than the network average to secure a better position in the next block. The winners in gas wars often pay several times the average transaction price to secure their position.

Usually, gas wars are associated with highly coveted events with limited access, such as initial DEX offers (IDOs) and non-fungible tokens (NFTs), any event with a limited number of slots and many participants, or an occurrence of overcrowding. Users who want to have their transactions processed need to overpay on gas to secure a winning position in the next block. Those positions are also often vulnerable to frontrunners seeking to make a quick arbitrage profit.

The Otherdeed Mint War

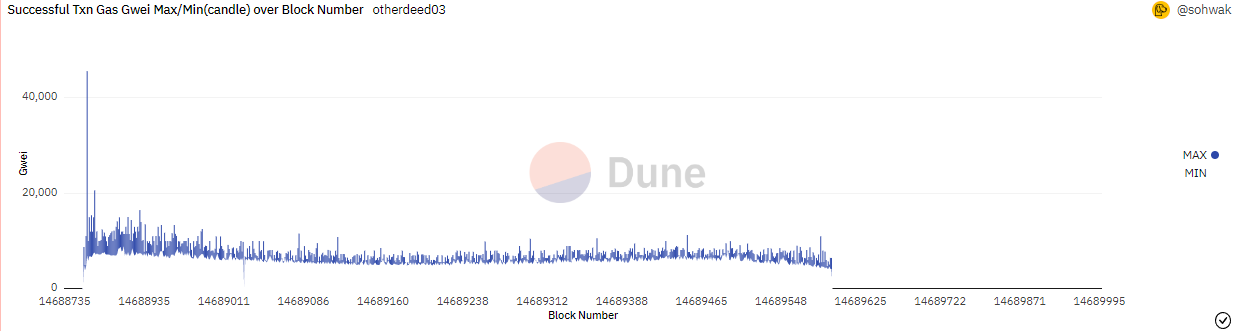

But let's dive into one of the most notable gas wars this year—the Otherdeed land mint. When the mint of the Otherside Land sale was announced for April 30, 2022, many expected a huge event, but it ended up breaking and congesting the ETH chain. Over 200m USD was paid in ETH gas during this time.

There will be a total of 200,000 Otherdeeds. The first 100,000 Otherdeeds were available on April 30, 2022. Those holding Bored Apes or Mutants were able to claim their Otherdeeds. The other ones will be open to mint by users registered in a KYC system and holding more than 305 APE$.

Minting started with block number 14688876 and continued until 14689597 or for roughly 3 hours. Within a minute, a successful mint with the lowest cost of 190 gwei and the highest cost of 45556 gwei occurred, or to put simply, the transaction resulted in potentially the biggest NFT mint and gas war ever.

Discover SynFutures' Crypto Derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.