SynFutures has announced the launch of Oyster AMM, the most capital-efficient AMM in DeFi derivatives, and a $22M Series B funding round.

After a successful early registration phase for V3, we’re excited to officially begin the rollout of the latest iteration of our protocol, starting with a public testnet.

The news comes on the heels of the close of our $22 million Series B funding round led by Pantera Capital, with participation from Susquehanna International Group (SIG) and HashKey Capital.

While V2 was a significant milestone in our product roadmap, V3’s release is the most significant update up to this point. Oyster AMM, our updated AMM model, builds upon the foundational architecture established in previous versions of SynFutures while welcoming a variety of features catered to the needs of everyday traders and professional participants.

But you may be wondering…

Why call it Oyster?

An important component of our updated AMM design is the liquidity boost achieved through our pearl necklace design. Like the“ticks” in Uniswap V3, which refers to the smallest increment by which the price of a security can move, every tick in Oyster AMM not only holds the meta information of concentrated liquidity but also contains all the limit orders at a certain price from makers — just like the pearls on a necklace. Hence, the name Oyster AMM.

The name also works for a variety of other reasons. It’s unique, and we believe that the idiom “The world is your oyster” rings true regarding V3; with SynFutures V3, the world of decentralized derivatives really is your oyster.

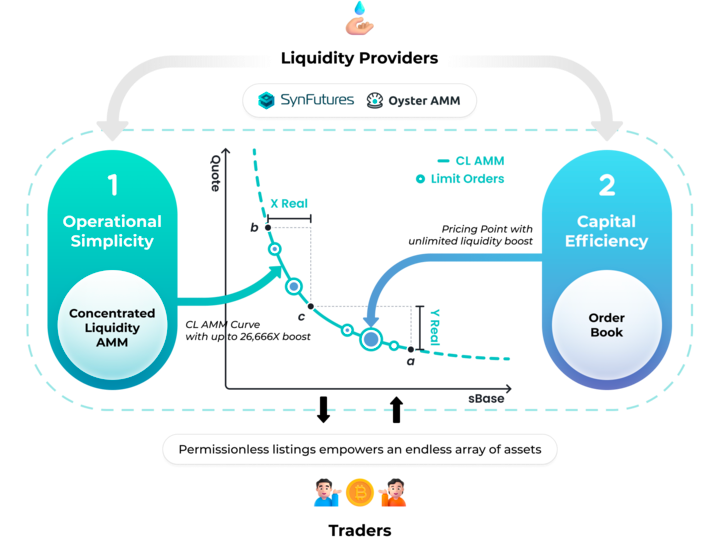

Combining AMM and Order Book

Oyster AMM is a one-of-a-kind model, combining the best of the order book and AMM to maximize capital efficiency and open up SynFutures’ decentralized derivatives trading infrastructure to a broader range of traders and investors 📈

Other features that define Oyster AMM:

Single-token concentrated liquidity

Oyster AMM introduces a margin management and liquidation framework created specifically for derivatives. The model embraces two-sided liquidity but only requires a single token, eliminating the need to provide liquidity for both ends of a token pair and enhancing the overall efficiency of the trading ecosystem.

Fully on-chain order book

AMM and order book models have their pros and cons. Due to their capital efficiency, we introduced an order book model in V3. The order book model is completely on-chain to guarantee transparency, trustlessness, and anti-censorship.

One model, unified liquidity

Oyster AMM offers a unified liquidity system tailored to active traders and passive liquidity providers. This cohesive approach ensures traders can enjoy efficient atomic transactions with predictability, unlike on-chain-off-chain combo systems where trade requests are split between these systems, leading to inefficiencies, non-atomic execution, and unpredictability.

User protections

The Oyster AMM introduces advanced financial risk management mechanisms from past protocol iterations to enhance user protection and price stability, including a dynamic penalty fee system that discourages price manipulation and balances the LP’s risk-reward profile. The other is the stabilized mark prices mechanism, which uses an exponential moving average process to mitigate the risk of sudden price fluctuations and mass liquidations.

For more information on Oyster AMM and V3, read the whitepaper draft.

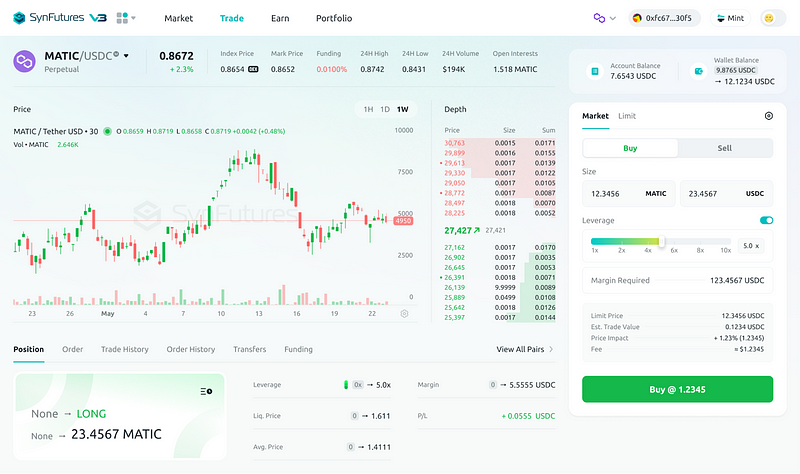

Trading on SynFutures V3

While V3 appeals to a broader range of traders and LPs, the trading experience is still designed to be a streamlined, easier-to-navigate user experience for traders and liquidity providers.

Please note that the mobile version of V3 is still in development. For now, please access the testnet using a web browser.

You may have also noticed we’ve updated our website to reflect V3 and our expanded offerings. To access the platform, go to the right-hand corner of the landing page. If browsing on a mobile device, simply click the navigation menu at the top right to access.

Like on our previous landing page, you can find resources at the top, including the V1 and V2 whitepapers. If browsing on a mobile device, select the navigation menu at the top right and click “Resources.”

What’s Next?

Following the public testnet, we’ll open up the platform on mainnet, which is expected at the end of the year. To stay updated on the latest V3 developments, follow SynFutures on X and Discord.

Access the testnet.

About SynFutures

SynFutures is a leading perp DEX that creates an open and trustless derivatives market by enabling trading on anything with a price feed anytime. SynFutures democratizes the derivatives market by employing an Amazon-like business model, giving users the tools to freely trade any assets and list arbitrary futures contracts within seconds.

Deployed on multiple blockchains, SynFutures is currently the largest derivatives exchange on Polygon and is among the top three most actively used decentralized derivatives exchanges. Backers include Tier 1 Web3 institutional investors Pantera Capital, Polychain Capital, Susquehanna International Group (SIG), Dragonfly Capital, Standard Crypto, and Framework Ventures, and team members have extensive experience at global financial institutions, fintech companies and blockchain technology companies such as Alipay, Bitmain, Credit Suisse, Deutsche Bank, Matrixport, and Nomura Securities.

Learn more: