Proof of Reserve refers to verifying the balance held by centralized cryptocurrency exchanges or custodians to ensure they possess all the assets they claim to hold on behalf of their customers. Often, this process employs a cryptographic data structure called Merkle tree to provide transparent and verifiable data, assuring customers that their assets within the exchange are not being misused. Ideally, the audit is carried out by a third-party auditor, but many exchanges currently rely on self-audited reports.

Proof of reserve can be published as a report at regular intervals or a dashboard that provides continuous live data. In either case, the purpose is to help build trust and transparency between the exchange and its customers.

Why Proof of Reserve is Needed

Unlike decentralized exchanges, a centralized exchange takes custody of its customers’ funds, making them vulnerable to potential misuse by malicious entities. This was the case with the infamous FTX exchange, which has been accused of using almost $10 billion of its customers' funds for its benefit.

History

Proof-of-Reserve has been a theoretical concept since 2014 when Zak Wilcox described it in his blog's ‘Proving you Bitcoin Reserves’ article. However, it did not see mainstream adoption until 2018, when Bitfinex published its Proof-of-Solvency proposal, showing that some crypto custodians are taking the concept more seriously. However, the main turning point came after the FTX debacle. Mass adoption started in 2022 after news about FTX misuse came to the limelight, causing many users to lose trust in centralized exchanges. The remaining centralized exchange started adopting the proof of reserve concept to regain this trust.

How It Works

As mentioned above, most exchanges use a Merkle Tree-based Proof of Reserve method to prove they have sufficient assets to match customer deposits. The method consists of two steps:

- Identifying total customer deposits.

- Identifying the total reserve on exchange wallets.

If the total reserve equals or exceeds the customer deposits, it’s safe to assume the exchange is solvent and has enough reserve to meet all user demands.

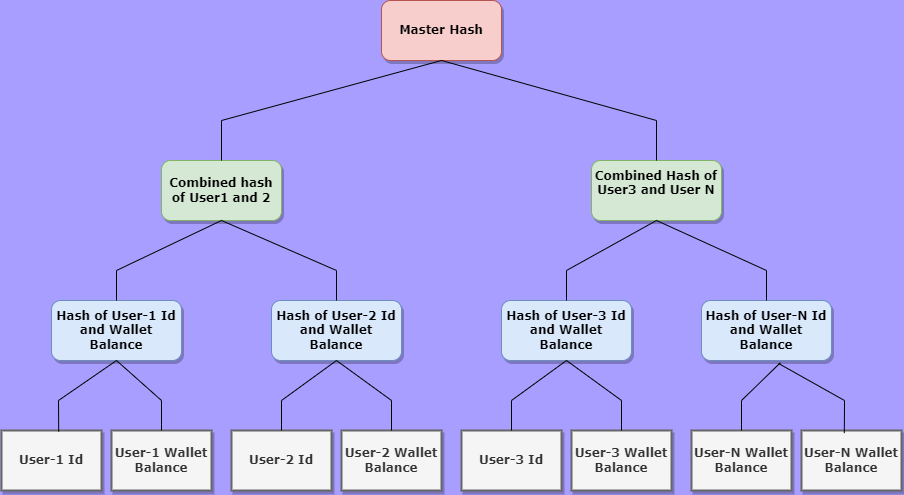

The process starts with an auditor taking a snapshot of an exchange’s deposits and reserves at any time. The snapshot uses a Merkle tree data structure to identify customer deposits. See the example below of a Merkle tree identifying all customer deposits.

As we can see, each user’s details are recorded and hashed to create a node. These nodes are then hashed together again to create a higher-level node. The process continues until we reach one Master hash called the Merkle Root. Since each hash is created using the previous hashes, changing any of the hashes will result in a change in the master hash of the Merkle tree.

Using this method, an auditing firm can verify the total user deposit on the exchange at any time. They can then check the total asset that the exchange has stored through different wallet addresses on the blockchain. If the exchange has more reserves than user deposits, it’s considered to have passed the proof-of-reserve test.

Benefits of Proof-of-Reserve

Following the FTX collapse, a large section of the cryptocurrency community started to doubt the reliability of centralized exchanges. Many exchanges subsequently introduced proof of Reserve to restore the lost trust. This feature enabled exchanges to provide verifiable evidence of sufficient reserves covering all customer deposits. Using the Merkle tree method also ensured that exchanges could prove their reserves without compromising user privacy. As only the hash of user IDs and balances are made public, users' actual identities and wallet balances remain anonymous.

As institutional investors show increasing interest in cryptocurrencies, many seek reliable third-party custodians for their digital assets. A well-audited Proof of Reserve can be essential in building trust within the ecosystem and facilitating the flow of capital from traditional finance to the crypto space.

Reliability of Proof-of-Reserve

Despite its advantages, Proof-of-Reserve is still not entirely foolproof. The biggest issue is the need for users to trust the competence and integrity of the auditor performing the audit. So, the process isn’t entirely trustless. Instead, the trust shifts from the exchange to the auditor. Proof-of-Reserve can be considered more reliable if a competent third party conducts the audit. However, if it was done by any unknown firm or the exchange itself, it becomes difficult to trust the process.

Conclusion

Proof of Reserve has emerged as an important tool in the Web3 ecosystem, helping to build trust in centralized exchanges and other custodians. A properly conducted Proof of Reserve at regular intervals can boost user confidence in the exchange and allow regulatory agencies to consider the ecosystem more favorably, as it shows the industry cares about rooting out bad actors and implementing self-regulatory measures to prevent misconduct.

However, we must all keep in mind that one of the primary goals of the cryptocurrency ecosystem is the self-custody of our assets. Giving custody of our assets to a third-parties should always be a last resort. While Proof of Reserve is a great concept, it is not a replacement for self-custody. Remember the oldest maxim of the industry ‘Not your keys, not your crypto.'

Discover SynFutures' crypto derivatives products: www.synfutures.com/.

Disclaimer: SynFutures Academy does not guarantee the reliability of the site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any SynFutures Academy article are solely those of the author(s) and do not reflect the opinions of SynFutures. The SynFutures Academy articles are for educational purposes or information only. SynFutures Academy has no relationship to the projects mentioned in the articles, and there is no endorsement for these projects. The information provided on the site does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions.